The Ultimate Guide to CD Ladder Strategies (And Why They Might Be a Smart Move in 2025)

The CD ladder strategy is one of my favorite ways to boost savings yield without giving up too much flexibility. Here's how to fast-track building a CD ladder that actually…

401k Performance Secrets: Why Your Balance Is Lying to You

Two executives, same $200K salary, same $30K annual 401k contributions. After 10 years, one has $150,000 more than the other. The difference? A 15-minute quarterly calculation that 90% of high…

The Smart Way to Finance a Remodel in 2025: HELOC vs HELOAN vs the Rest

When it comes to paying for a home renovation, tapping into your home equity can be a smart move -- or a seriously expensive misstep. The key is choosing the…

Stagflation-Proof Your Money: The No-BS Guide to Financial Survival

With its combination of high inflation, weak growth, and job market jitters, stagflation screws with your money. Here's how to manage your money to fight back against stagflation, why this…

Financial Education Thoughts For Young Kids

A recent study by Capital One reveals that the average American spends over $3,300 annually on impulse purchases – habits that often start in childhood. Yet, only 23% of kids…

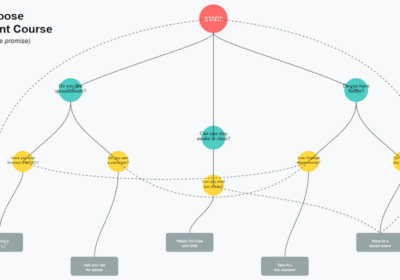

17 Top Retirement Planning Courses 2025: Pick Right, Live Well

A recent survey found that 20 percent of Americans above the age of 50 have no retirement savings, and more than half are worried they will not have enough money…

How Retirees Can Achieve Financial Stability and Build an Emergency Fund

Retirement marks a significant life transition—one filled with opportunities to enjoy the fruits of decades of hard work. However, it also brings unique financial challenges. With income often limited to…

How to Use a Balance Transfer to Get Out of Debt Fast

You can cut your credit card debt down to zero — without robbing a bank or coming into an inheritance. That's the power of a balance transfer. And it doesn't…

Smart Strategies to Reduce Your Fixed and Variable Expenses

In today's economic climate, managing expenses isn't just about cutting costs—it's about making smart choices that maintain your quality of life while building financial security. As a financial advisor who's…

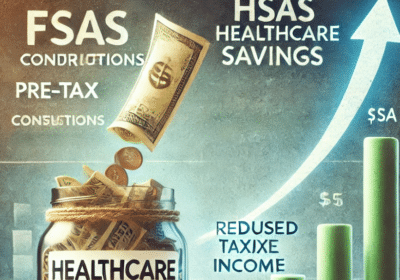

FSA vs HSA: A Complete Guide to Understanding Your Healthcare Savings Options

Managing healthcare costs effectively is a challenge for many, but Flexible Spending Accounts (FSAs) and Health Savings Accounts (HSAs) offer valuable tools to help. These accounts provide tax advantages that…

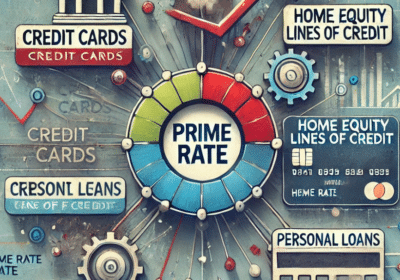

Understanding the Impact of Prime Rate on Borrowers

In the past year alone, millions of American borrowers have seen their monthly payments increase - some by hundreds of dollars - due to prime rate changes. With most credit…

CD Rates Guide: When to Lock In High-Yield Savings for Better Returns

In today’s evolving financial landscape, the appeal of high-yield savings accounts and certificates of deposit rates (CD rates) has significantly grown. With interest rates shifting frequently, these financial tools present…

The Why and How (and How Long) of Keeping Credit Card Statements

In 2024, statistics show that nearly a third of card-holders have been hit by credit card fraud. With the average American making 23 card transactions each month (that's over 200…

401(k) Vesting Explained: Don’t Leave Your Free Money Behind

In 2024, the average employer 401(k) match reached $3,500 annually, yet an estimated 23% of employees forfeit their match by leaving jobs before becoming fully vested. That's nearly $800 million…

7 Smart Ways to Boost Your Holiday Budget

The average American spends over $1,000 during the holiday season, creating financial stress for many households. While planning ahead is ideal, there are still effective strategies to build your holiday…

Moving Budget Tips: How to Save Thousands on Your Next Move

When I moved from California to Austin, I learned an expensive $12,000 lesson about moving costs. Like many people, I opted for what seemed easiest – a full-service moving company…

The Secret to Financial Growth: Best Saving Strategies Explained

In 2024, the average American spends nearly $3,381 each year (roughly $282/ month) on impulsive purchases, reveals a survey by Capital One. Unplanned spending thus makes up a staggering 21%…

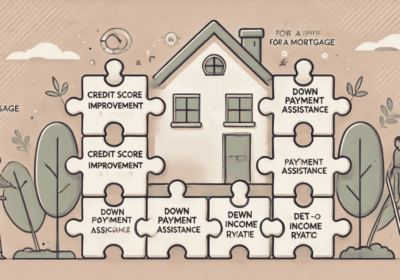

3 Proven Ways to Qualify for a Mortgage with Low Income

"Your income is too low for mortgage qualification." These words have crushed the homeownership dreams of countless aspiring buyers. But here's what traditional lenders won't tell you: there are proven…

All You Need to Know about Subprime Personal Loans

Kate’s 540 credit score was holding her back. After losing her job during the pandemic and dealing with an auto accident that required major repairs to her car, she struggled…

Easy Guide to The What, When, Why & How of Bookkeeping and Accounting

In a recent study, the American Institute of CPAs (AICPA) discovered that nearly 60% of Americans feel overwhelmed at the thought of managing their finances. Deciding whom to turn to…

Smart Savings Strategy: Multiple Retirement Accounts

Smart Savings Strategy: Multiple Retirement Accounts Consider that, if you have an annual income in the range of $65,000 to $70,000, proper structuring of your retirement accounts can easily save…

Master Money Management: Simple Tips For Achieving Your Goals

A 2024 survey found that one out of two Americans (51%) do not think they will have enough money saved when the time comes to retire. What's more, the deficit…

Personal Capital Review 2024: Pros, Cons and Features

If you're looking for a tool that will give you Wall Street-like returns (without requiring you to live in New York), consider using Personal Capital. Created in 2009, Personal Capital…

Acorns vs Robinhood, Webull & M1 Finance: Best App in 2024

Are you looking to up your investing game? Do you want the stock market to make your money work for you? Are you sick and tired of sitting on the…

60k a Year Is How Much an Hour? (And How Do I Budget for That Salary?)

60k a year is how much an hour? And how do you budget for a 60k salary? Let's find out. If you're a high school teacher, public relations specialist, zoologist,…

Solo 401k vs SEP IRA: Best Retirement Plan for Self-Employed

Self-employment can offer an excellent work-life balance, as well as other freedoms and lifestyle benefits! Hahaha...wasn't that funny. Seriously though, self-employment will likely be the cause of you working 80…

The Benefits of Money Lending Apps: Unlock Financial Freedom

Money lending apps enable lending firms to offer their clients a secure, swift, and user-friendly avenue for acquiring necessary funds and repaying loans. These apps are revolutionizing the way individuals…

Big Picture Investing 101: Why You Should Care in 2024

If you have been poking around my blog, you’ve probably figured out that my ultimate goal is to help you reach some version of "financial independence" (or even just plain…

Personal Budget Categories: How to Decide +Free Template (GSheets & Excel)

Do you want to maximize your income and invest your savings in order to increase your net worth and maybe even retire early? Well then, it all starts with a…

17 Mindset Differences: How the Rich Think vs The Poor

I hate to put things in terms of the rich vs poor, but when it comes to amassing and keeping money, wealthy people do think inherently differently from poor people.…

Find a Free Checking Account You’ll End Up Loving

Find a Free Checking Account You’ll End Up Loving was written by Cindy (Money Dreamer) and originally appeared on Wealth of Geeks. Cindy is the founder of The Money Dreamer,…

What Is a Hedge Fund? Unraveling the Mysteries of Alternative Investments

What Is a Hedge Fund? Unraveling the Mysteries of Alternative Investments was written by Prakash Kolli and originally appeared on Wealth of Geeks. Prakash Kolli is the founder of the…

10 Ways To Get Free Government Money

10 Ways To Get Free Government Money was written by Linda Meltzer and originally appeared on Wealth of Geeks. Linda is the founder of The Cents of Money, a personal…

6 Best Debit Cards for Kids To Build Financial Literacy

6 Best Debit Cards for Kids To Build Financial Literacy was written by JayDee Vykoukal and originally appeared on Wealth of Geeks. JayDee is a mom, writer, and Doctor of…

The Independent Contractor (1099 Employee) Guide to Finances

Hey there, fellow freelancer! Ready to take charge of your finances and make the most of your independent contractor status? Being your own boss comes with some sweet perks, including…

Become a Millionaire: 16 Critical Dos and Don’ts

It's no longer "Who Wants to Be a Millionaire" but how to become a millionaire. You don't have to be a contestant on a game show, win the lottery, or…

The Best Investments to Grow Your Passive Income in 2025

In 2025, the average American's bank savings account earns just 0.55% annually—barely enough to buy a cup of coffee with your yearly interest on $1,000. But here's the exciting part:…

How Much Money Should I Have Saved by 30 (and 40 and 50)?

As the American workforce ages, it's common to think about how much money you've set aside for retirement. You may also wonder if you've saved enough to leave the workforce,…

Incorporate Yourself: Save $$, Guard Assets, Gain Cred(it): 2024

So you are a freelancer or independent contractor, and you want to know how to incorporate yourself. Smart. I feel that if you are self-employed in this way, you're in…

Personal Bookkeeping Mastery: Budgeting, Tracking, Tools, and Techniques

According to a survey published in 2024 by leading financial analyst The Motley Fool, nearly 91 million Americans say that they’d have a hard time raising $400 in a pinch.…

8 Surprising Facts About Middle-Class Income in America

8 Surprising Facts About Middle-Class Income in America was written by JayDee Vykoukal and originally appeared on Wealth of Geeks. JayDee is a mom, writer, and Doctor of Physical Therapy.…

The Best Credit Cards for Teens To Learn Financial Responsibility

The Best Credit Cards for Teens To Learn Financial Responsibility was written by Stephanie Allen and originally appeared on Wealth of Geeks. It has been republished with permission. Please note…

Debt Relief Programs: A Comprehensive Guide to Financial Freedom

Debt Relief Programs: A Comprehensive Guide to Financial Freedom was written by Olu Ojo and originally appeared on Wealth of Geeks. Olu is a passionate entrepreneur who loves to blog…

9 Best Odd Jobs Many People Probably Didn’t Know About

9 Best Odd Jobs Many People Probably Didn’t Know About was written by Courtney Luke and originally appeared on Wealth of Geeks. Courtney Luke is a mother of three, wife,…

Protecting Love and Assets: 10 Unfiltered Opinions on Prenuptial Agreements

Let's face it, discussing prenuptial agreements isn't exactly the most romantic topic for couples gearing up to tie the knot. But it's a conversation that needs to happen, right? It's…

How Do Student Loans Work?

Higher education opens doors to knowledge, growth, and endless possibilities. Unfortunately, it also introduces the burden of student loans and the daunting question: how do student loans work? Managing debts…

Warren Buffett Investment Strategy: Top 10 Golden Rules

Picture this: a young kid, totally hooked on numbers, who turns those early passions into a journey that leads him to become one of the wealthiest and best-known investors on…

How To Calculate Annual Income: A Step-by-Step Guide

How To Calculate Annual Income: A Step-by-Step Guide was written by Madison Cates and originally appeared on Wealth of Geeks. Madison Cates is the founder of Joy and Thrill where she…

14 Ways To Save Money When Buying a House

14 Ways To Save Money When Buying a House was written by Noreen (Our Two Family) and originally appeared on Wealth of Geeks. Noreen is the creator of Our Two…

Is Rocket Money Safe To Use for Personal Money Management? An Honest Review

Is Rocket Money Safe To Use for Personal Money Management? An Honest Review was written by Chhavi Agarwal and originally appeared on Wealth of Geeks. Chhavi is a lawyer who…

13 Surprising Things You Can Buy With EBT

13 Surprising Things You Can Buy With EBT was written by Jude Uchella and originally appeared on Wealth of Geeks. Jude Uchella is a passionate research writer whose work has…

How To Make Money From Home: 32 Best Ways To Try Today

How To Make Money From Home: 32 Best Ways To Try Today was written by Marjolein Dilven and originally appeared on Wealth of Geeks. Marjolein Dilven is a journalist and…

Free Always Tastes Good: 84 Restaurants That Offer Free Birthday Food

Free Always Tastes Good: 84 Restaurants That Offer Free Birthday Food was written by JayDee Vykoukal and originally appeared on Wealth of Geeks. JayDee is a mom, writer, and Doctor…

Are Solar Panels Worth It? A Friendly Guide To Weighing the Pros and Cons

Are Solar Panels Worth It? A Friendly Guide To Weighing the Pros and Cons was written by Jenny Kim and originally appeared on Wealth of Geeks. It has been republished…

Online Side Hustles: Maximizing Your Income Streams

Online Side Hustles: Maximizing Your Income Streams was written by Creshonda Smith and This article originally appeared on Wealth of Geeks. It has been republished with permission. Please note that…

Captivating Profits, Controversial Practices, and Corporate Plundering: What Is Private Equity?

Captivating Profits, Controversial Practices, and Corporate Plundering: What Is Private Equity? was written by Sam Stone and This article originally appeared on Wealth of Geeks. Sam is the creator of…

How To Get Free Baby Stuff: 12 Sneaky Strategies To Try

How To Get Free Baby Stuff: 12 Sneaky Strategies To Try was written by Jon Dulin and originally appeared on Wealth of Geeks. Jon is the founder of MoneySmartGuides, which…

How to Double Your Money (Without Becoming a Financial Genius)

How to Double Your Money (Without Becoming a Financial Genius) was written by Anika Jindal and originally appeared on Wealth of Geeks. Anika is a CPA and founder of What…

How Much Does It Cost To Charge an Electric Car?

How Much Does It Cost To Charge an Electric Car? was written by Abbie Clark and originally appeared on Wealth of Geeks. Abbie Clark is a passionate automotive enthusiast and…

What Bank Does Cash App Use?

What Bank Does Cash App Use? was written by Latoyia Downs and originally appeared on Wealth of Geeks. Latoyia is a travel enthusiast and founder of the travel blog, The Impulse…

How To Make a Fortune in Finance: 18 Best Paying Jobs in Finance

How To Make a Fortune in Finance: 18 Best Paying Jobs in Finance was written by Marjolein Dilven and originally appeared on Wealth of Geeks. Marjolein, the founder of Radical…

How To Make Extra Income While Working Full-Time: 13 Practical Ways for You

How To Make Extra Income While Working Full-Time: 13 Practical Ways for You was written by Chhavi Agarwal and originally appeared on Wealth of Geeks. Chhavi is a lawyer who…

10 Best Tips for Saving Money at the Grocery Store

This list is an eye-opener for shopping smart and saving money at the grocery store. With so much financial stress, it's good to save when and where you can, and…

16 Big (And Little) Money Wasters That People Indulge Anyway!

Americans have several collective addictions, and wasting money is among the nastiest. Yet, for some reason, we forget how hard we worked to earn the money when it comes time…

Elevate Your Career: Discover Lucrative Product Tester Jobs and Work-From-Home Opportunities

Elevate Your Career: Discover Lucrative Product Tester Jobs and Work-From-Home Opportunities was written by Jeff Fang and originally appeared on Wealth of Geeks. Jeff is a pupil of life and…

7 Awesome Personal Finance Books That Will Increase Your Wealth (and Improve Your Life)

Almost 37% of Americans making under $50,000 a year, and another 18% earning between $50,000 and $74,000, don't have enough savings for emergencies. That's bad! If your money situation also…

7 Clever Ways To Curb Your (Or Your Family’s) Impulse Buying Online

Who loves the feeling of a package showing up on your doorstep with your latest find? But a pile of boxes arriving daily could be a sign that you're in…

10 Of The Dumbest Purchases People Regretted Immediately (But Were Also Kinda Funny:)

What are the dumbest purchases you have ever made? Well, I have made my share of idiotic investments. For example, I accepted a "free tablet" from my cell phone carrier…

10 Clever Ways to Save Money: Start Today

Saving money is a goal for many people, but it can often feel daunting and overwhelming. The good news is that many small habits can help you save money over…

10 Best Examples of Money Well Spent

We all want to save money when possible, especially those who must or choose to live more frugally. But, on the flip side, some purchases are worth the expense for…

10 Worst Money-Making Scams Preying on Unsuspecting Folks

The only thing more lacking than Americans' financial literacy rates is their...literacy rates. Schools aren't doing anything to prepare students for the ruthless realities of the financial system, and many…

10 Ridiculously Funny Scams People Admitted to Falling for

Scams may be as old as recallable memories, but the advent of the internet took them to all new levels. Of course, you're likely conversant with the classic "Nigerian Prince"…

Self-Employed Tax Deductions: The Basics About 10 Essential Ones

Self-Employed Tax Deductions: The Basics About 10 Essential Ones was written by Prakash Kolli and originally appeared on Wealth of Geeks. Prakash Kolli is the founder of the Dividend Power…

How Can I Manage My Finances? Your Path to Prosperity!

Do the anxiety-inducing questions, “How can I manage my finances better?” and "Where do I even begin?" constantly plague your thoughts? You're not alone. More than half of Americans are…

10 Best Expensive Things to Buy that Could Save You Money, Time, and Improve Your Life

Are you searching for ways to improve your life, save time, or save money? Investing in expensive items can be a colossal waste. However, sometimes it is an intelligent decision…

What Is Annual Income? Significance and Calculation Insights

'Annual Income' is widely recognized as the most valuable metric for quick and comprehensive calculations, whether for reporting taxes, applying for loans, or making a budget, whether on a personal…

10 Unethical Businesses Who Make Money by Exploiting the Uneducated and Desperate

It is no secret that many shady businesses prey on those in need to make profits. However, people should be aware of these rip-off schemes and stay vigilant. Here are…

10 Bad Money Habits That Are Keeping You Broke

We all have habits that we fall into, but some of these habits can be harmful to our finances. In fact, certain bad money habits can even make us go…

10 Unusual Ways to Make Money: Wealthy Folks Revealed

When it comes to managing money, there's no one-size-fits-all approach. However, it's often helpful to take cues from those who have accumulated wealth and learn from their habits and strategies.…

10 Precious Things Money Can’t Buy in Your Life

Are you tired of purchasing one thing after the next in hopes of finding happiness and fulfillment? Well, some precious things in life are invaluable. So put away your wallet,…

10 Ways to Make Quick Cash When You’re in a Pinch

A pinch is an awkward place, but nearly everyone has been there. The bills sometimes pop up from nowhere, and regaining balance requires that you raise money at light speed.…

10 Unbelievably Stupid Things to Spend Money On (Revealed by People)

It's wise to be frugal regarding money, and that notion applies more than ever in today's trying economic times. But some insist on spending their hard-earned cash liberally on silly…

10 Ways to Invest Money in 2023

It's quarter way into 2023, and with the depressing price hikes, major banks liquidating, and the United States Treasury announcing a potential default in national debt, it is natural if…

11 Best Tips for Talking To Aging Parents About Their Retirement and Finances

Talking to aging parents about death and their estate can be very hard, but it is a fact of life unless you predecease them. A worried Internet forum member asked…

Assets Versus Liabilities: Knowing The Difference for Financial Success

Assets Versus Liabilities: Knowing The Difference for Financial Success was written by Chris Alarcon and originally appeared on Wealth of Geeks. Chris is the driving force behind Financially Well Off…

14 Costco Benefits That Make It a Best-In-Class Employer

14 Costco Benefits That Make It a Best-In-Class Employer was written by Sam Stone and originally appeared on Wealth of Geeks. Sam is the creator of the personal development blog…

How Much Should I Have in Savings? A Guide to Financial Security

How Much Should I Have in Savings? A Guide to Financial Security was written by Anika Jindal and originally appeared on Wealth of Geeks. Anika is a CPA and founder…

Is $700.00 a Week a Good Amount of Allowance for Teenagers? (10 Thoughts)

Here's a question people must be asking: how much pocket money is enough for a child in modern times? However, I am not sure many parents will ask if $700…

11 Tried and Tested Ways To Save Money This Year

11 Tried and Tested Ways To Save Money This Year was written by Danny Newman and originally appeared on Wealth of Geeks. Danny Newman is a digital nomad from the…

5 Reasons Retail Traders Lose Money

5 Reasons Retail Traders Lose Money was written for Playlouder by a Cristina Par. Please note that contributing opinions are that of the author. They are not always in strict…

A Step-By-Step Guide on How to Write a Check

Have you ever found yourself in a situation where you need to write a check but feel uncertain about how to do it properly? Writing a check may seem like…

The Financial Planning Process: Your Route to Financial Independence!

The financial planning process is all about "planning" for your retirement far before your arrival there. You need to think of retirement as a destination. I like to call it…

Taking the Guesswork out of FHA Mortgages: How the FHA Mortgage Calculator Can Simplify Your Home Buying Journey

Taking the Guesswork out of FHA Mortgages: How the FHA Mortgage Calculator Can Simplify Your Home Buying Journey was written for Playlouder by a contributing author. Please note that contributing…

What Is a Trust Fund and How It Works

You may have heard the term "trust fund" thrown around regarding estate planning. But what is a trust fund, and how does it work? Let's break down the basics of…

10 Great Financial Insights: What You Wish You Did in Your Twenties?

Many of us make financial decisions in our twenties that we may regret. Whether it's failing to save for retirement, investing in the wrong assets, or simply spending too much…

Avoid These Pitfalls Like The Plague When You Get A Pay Raise

Avoid These Pitfalls Like The Plague When You Get A Pay Raise was written by Amaka Chukwuma and originally appeared on Wealth of Geeks. Amaka Chukwuma is a freelance content…

How To Build Wealth at Any Age

How To Build Wealth at Any Age was written by Ben Hoffman and originally appeared on Wealth of Geeks. It has been republished with permission. Please note that contributing opinions…

How to Make Your Money Work for You: 7 Modern Methods for Investing in “The Market”

You work hard for your money – but does your money work hard for you? No one wants to work until they die, right?If you feel like you never have…

A Robo Advisor Comparison: Can A.I. Get You to the Promised Land?!

I wanted to create a distilled robo-advisor comparison for you to check out. Mainly because they are cool, but also because they are (potentially) a great step closer to financial…