YOUTUBE VIDEO: What should you do with retirement accounts after changing jobs

Hey there! In this video, I discuss what to do with your retirement account when changing jobs. I cover immediate steps, potential problems, and the importance of setting up a…

YOUTUBE VIDEO: Why Would Retires Work With A Professional Tax Preparer

Hey there! In this video, I delve into why retirees might opt for a CPA for their taxes, focusing on tax efficiency and complexities. I discuss the cost range of…

YOUTUBE VIDEO: You saved 50K! Now What?!?!

In this video, I discuss key financial decisions when your savings reach $40,000-$60,000. I address questions on savings placement, emergency funds, tax efficiency, and debt management. I suggest high-yield savings,…

YOUTUBE VIDEO: Discover If WordPress Is Right For Your Small Business

Hi there! Join me in this video where I share insights on WordPress, a free, open-source platform for website building. I discuss the differences between WordPress, Squarespace, and Wix, highlighting…

YOUTUBE VIDEO: Pay Back Student Loans Faster By Cutting These Expenses

Hey there! In this video, I discuss some practical financial tips to help you save money. I highlight the importance of delaying getting a pet until your loans are managed,…

YOUTUBE VIDEO: Are You Financially Ready to Buy a House?

In this video, I discuss the key signs indicating financial readiness to buy a house. I cover aspects such as down payments, debt-to-income ratio, long-term planning, family considerations, and emergency…

YOUTUBE VIDEO: Strategies To Become Debt-Free Faster

In this video, I delve into the concept of debt, distinguishing between secure and unsecured debts like mortgages and credit cards. I emphasize the importance of managing high-interest credit card…

YOUTUBE VIDEO: Quicken Tutorial: How to Wrangle & Categorize Your Amazon Purchases

Have you been categorizing all your Amazon purchases under one Quicken category? There's a better way. In this easy tutorial, I'll show you how to handle your Amazon purchases like…

YOUTUBE VIDEO: Should You Take a Loan From Your 401k Before Retiring (or any other time)?

Hey there! In this video, I delve into the question of whether taking a loan from your 401k is a wise move. I discuss various scenarios where it could be…

YOUTUBE VIDEO: Finding Financial Relief from High Mortgage Payments

In this video, I discuss strategies for managing mortgage payments that are straining your finances. I explain the option of refinancing to lower interest rates and extend payment periods. It's…

YOUTUBE VIDEO: Situations Where You Would Use Your Emergency Fund

Hey there, it's Joe DiSanto. In this video, I discuss the importance of an emergency fund and when to use it. The primary scenario for using the fund is during…

YOUTUBE VIDEO: Is Your Current Retirement Savings Plan Enough For You?

In this video, I discuss the importance of personalized retirement savings rates based on individual financial goals. I emphasize the need for calculating exact savings amounts and investment returns rather…

YOUTUBE VIDEO: Who MUST Get a 1099 Form From You

In this video, I will explain the circumstances in which you would send a 1099. Frankly, it's quite confusing!

YOUTUBE VIDEO: The Secrets to Effortless 1099 Creation with Tax1099.com

Get ready to create 1099 forms effortlessly with Tax1099.com! Follow this step-by-step walk-thru to learn the secrets to easy 1099 creation.

YOUTUBE VIDEO: Quicken Tutorial: 1099 Creation Step-by-Step

Tax time can be stressful, but sending out 1099s doesn't have to be! In this Quicken tutorial, I teach you how to use your data from Quicken to create 1099s…

YOUTUBE VIDEO: Quickly (And Accurately) Generate Your 1099s with QuickBooks Online

Learn how to quickly generate your 1099s with QuickBooks Online in this step-by-step tutorial. I'll simplify the process, help you avoid pitfalls, and ensure you stay compliant with tax regulations!

YOUTUBE VIDEO: Can You Use 401k Money For A Down Payment On A House?

In this video, I discuss the option of utilizing 401k funds for a down payment on a house. I explain the rules and regulations surrounding 401ks, including the possibility of…

YOUTUBE VIDEO: Smart Strategies for Roth 401k Conversions and Retirement Planning

In this video, I discuss the differences between traditional and Roth 401k accounts, focusing on tax implications and strategic conversion opportunities. I explain how each account type works, the tax…

YOUTUBE VIDEO: Two Simple Yet Effective Ways to Boost Your Credit Score

Hey there! In this video, I discuss the two most powerful ways to improve your credit score. Firstly, removing late payments and delinquencies can significantly boost your score, although it…

YOUTUBE VIDEO: A Beginner’s Guide to Purchasing Bitcoin Easily

Hey there, it's Joe DiSanto. In this video, I discuss simple methods to purchase small amounts of Bitcoin, like $5,000 or less. I explain how ETFs offer easy exposure to…

YOUTUBE VIDEO: EINs, TINs or ITINs – What’s the Best Choice for You?

Hey there! In this video, I break down the differences between EINs, TINs, and ITINs. EIN is like a social security number for your business, while TIN covers a broader…

YOUTUBE VIDEO: WARNING Don’t Fall Victim to Predatory Debt Consolidation

In this video, I discuss predatory lending, focusing on debt consolidation. Predatory lending involves financial institutions using deceptive tactics, hidden fees, and lack of transparency. I explain the two methods…

YOUTUBE VIDEO: Can You REALLY Afford Housing Costs on Social Security?

In this video, I delve into the average 2024-2025 Social Security benefits vs housing costs, focusing on the average payout of around $2,000 a month. I compare housing costs in…

YOUTUBE VIDEO: Building Wealth and Smart Money Moves

Hey there! In this video, I discuss the reasons why some Americans build wealth more successfully than others and share insights on smart money moves. I highlight the importance of…

YOUTUBE VIDEO: What’s Holding You Back from Achieving Financial Independence?

Hey folks, in this video, I delve into the concept of the Financial Independence (FI) ratio, a key metric in the FIRE (Financial Independence, Retire Early) movement. I explain how…

YOUTUBE VIDEO: Tips to Manage Compulsive Online Spending

In this video, I discuss the dangers of compulsive spending, especially in the age of online shopping. I provide strategies like implementing time delays before purchases and seeking approval from…

YOUTUBE VIDEO: Don’t Let Cash Gifts Ruin Your Holiday Cheer! Know the Tax Rules

Hey there! In this video, I delve into the best money gifts for holidays, discussing cash, stocks, and savings bonds. I explain how the choice depends on the recipient's age,…

YOUTUBE VIDEO: Can You Live Off $500,000 for the Rest of Your Life?

Hello, it's Joe DiSanto discussing the adequacy of $500,000 for retirement and money management strategies. I emphasize understanding retirement needs, cost of living, and investment returns. I urge you to…

YOUTUBE VIDEO: Will You Outlive Your MONEY? The Hidden Dangers of Longevity Risk?

Hello, it's Joe DiSanto. In this video, I delve into the concept of longevity risk in retirement planning. With advancements in medical care, we're living longer, posing challenges to sustaining…

YOUTUBE VIDEO: Want College Savings Success? Watch This 529 Plans Guide

In my YouTube session, I discussed 529 plans, emphasizing that account ownership affects control and financial aid considerations. I advise considering alternatives like custodial accounts or irrevocable trusts for more…

YOUTUBE VIDEO: Are You Prepared for the Next Economic Downturn?

Hey there! In this video, I discuss the idea of holding cash during a recession for financial security. I explore the importance of emergency funds and the balance between comfort…

YOUTUBE VIDEO: STOP Letting Holiday Spending Drain Your Home Equity

Hey there! In this video, I discuss the idea of using home equity to cover holiday spending. I explain when it might be wise to tap into home equity for…

YOUTUBE VIDEO: Is Financing Holiday Gifts REALLY Worth the Cost?

In this video, I address the question of whether it's advisable to finance holiday gifts through methods like credit cards, buy now pay later, or personal loans. I emphasize the…

YOUTUBE VIDEO: Real Estate in Retirement Planning

Hey there, it's Joe DiSanto. I discuss the pros and cons of including real estate in your retirement plan. Real estate can offer equity appreciation but may not provide reliable…

YOUTUBE VIDEO: Understanding the Importance of Updating Beneficiaries on Your Accounts

As I discuss the significance of updating beneficiaries on accounts, I highlight the consequences of not having a designated beneficiary. It's crucial to ensure that your money goes to the…

YOUTUBE VIDEO: Understanding the Role of Checking Accounts

Hi there! In this video, I share my personal approach to managing my checking account and how it fits into my financial strategy. I explain how I use my checking…

Financial Education Thoughts For Young Kids

A recent study by Capital One reveals that the average American spends over $3,300 annually on impulse purchases – habits that often start in childhood. Yet, only 23% of kids…

YOUTUBE VIDEO: Credit Cards vs Debit Cards Making the Most of Your Purchases

Hey everyone, it's Joe DiSanto. Today, I delve into the debate of using debit cards vs credit cards based on a recent survey on holiday shopping preferences. I advocate for…

YOUTUBE VIDEO: Maximizing Credit Card Rewards

Hey there, it's Joe D.! Today, I delve into the topic of using credit card points as cash for purchases. Did you know 29% of Americans use rewards points as…

YOUTUBE VIDEO: What You Don’t Know About Financial Fraud is Putting You at Risk

In this video, I delve into different types of financial fraud, focusing on fraud within accounts and on credit reports. I explain common signs of fraud, how to detect it,…

YOUTUBE VIDEO: The SMART Way to Build an Emergency Fund

Hey there! In this video, I delve into calculating the duration of emergency savings in case of income loss. I emphasize the importance of basing your emergency fund on actual…

YOUTUBE VIDEO: DON’T Get Caught in The Trading Volume TRAP!

In this video, I discuss whether using trading volume as a criterion for investing in cryptocurrencies is a good strategy. I explain why I personally wouldn't rely on trading volume…

17 Top Retirement Planning Courses 2025: Pick Right, Live Well

A recent survey found that 20 percent of Americans above the age of 50 have no retirement savings, and more than half are worried they will not have enough money…

YOUTUBE VIDEO: Quicken for Mac Tutorial: Menus Overview

Learn how to use the various menus in Quicken for Mac. I'll explain the important features of each menu, as well as how to customize and get the most out…

YOUTUBE VIDEO: Personal Finance Insights

In this video, I discuss common personal finance advice and whether it still holds true, especially in unique scenarios like the impact of COVID-19. I question the effectiveness of traditional…

YOUTUBE VIDEO: Understanding Social Security Benefits

In this video, I discuss important factors that can impact your social security benefits, such as early withdrawal implications, working while receiving benefits, disability considerations, legal implications, and how your…

YOUTUBE VIDEO: End of Year Planning Thoughts for Small Businesses

Hey there, it's Joe DiSanto. In this video, I discuss crucial end-of-year tax planning for small businesses, focusing on tax considerations, deductions, and retirement savings like the Solo 401k. I…

YOUTUBE VIDEO: 4 Types of Tax Professionals You Can Hire

In this video, I discuss the four main ways to get your tax return done, ranging from self-filing to working with different tax professionals. I highlight the importance of choosing…

YOUTUBE VIDEO: Wealth-Destroying Mistakes

Hey there, it's Joe DiSanto. In this video, I discuss common wealth-destroying mistakes, emphasizing the importance of early financial planning, asking for raises, learning about investing, and working with investment…

YOUTUBE VIDEO: Budget Calendars Explained

In this video, I delve into the significance of budget calendars as essential tools for managing finances effectively. I explain how budget calendars serve as cash flow projections, aiding in…

How Retirees Can Achieve Financial Stability and Build an Emergency Fund

Retirement marks a significant life transition—one filled with opportunities to enjoy the fruits of decades of hard work. However, it also brings unique financial challenges. With income often limited to…

YOUTUBE VIDEO: Quicken for Mac Tutorial: Account Bar Walk-Thru

Learn how to properly use the account bar in Quicken for Mac. I'll teach you how to add and accurately read the data in the account bar, such as your…

YOUTUBE VIDEO: 9 Tax Savings Opportunities for Everyone

In this video, I discuss various tax-saving strategies for individuals, including utilizing 401k contributions, considering home ownership for tax benefits, and exploring the tax advantages of getting married and having…

How to Use a Balance Transfer to Get Out of Debt Fast

You can cut your credit card debt down to zero — without robbing a bank or coming into an inheritance. That's the power of a balance transfer. And it doesn't…

Smart Strategies to Reduce Your Fixed and Variable Expenses

In today's economic climate, managing expenses isn't just about cutting costs—it's about making smart choices that maintain your quality of life while building financial security. As a financial advisor who's…

YOUTUBE VIDEO: Understanding Credit Card Disputes 💳

In this video, I discuss types of credit card charges you can dispute with your credit card company, such as fraud and incorrect charges. I explain the process of disputing…

YOUTUBE VIDEO: Quicken for Mac Tutorial: How to Add Bank Accounts

Learn how to add bank accounts in Quicken for Mac. I'll walk you through the process of setting up your accounts. Then, I'll explain how to work with your accounts…

FSA vs HSA: A Complete Guide to Understanding Your Healthcare Savings Options

Managing healthcare costs effectively is a challenge for many, but Flexible Spending Accounts (FSAs) and Health Savings Accounts (HSAs) offer valuable tools to help. These accounts provide tax advantages that…

Understanding the Impact of Prime Rate on Borrowers

In the past year alone, millions of American borrowers have seen their monthly payments increase - some by hundreds of dollars - due to prime rate changes. With most credit…

CD Rates Guide: When to Lock In High-Yield Savings for Better Returns

In today’s evolving financial landscape, the appeal of high-yield savings accounts and certificates of deposit rates (CD rates) has significantly grown. With interest rates shifting frequently, these financial tools present…

YOUTUBE VIDEO: Quicken Tutorial: “Bill Pay” vs the Bill Module

In this video, I will discuss the distinction between Quicken BillPay, an additional, extra-paid feature, and the BillPay module, which is just part of the software.

The Why and How (and How Long) of Keeping Credit Card Statements

In 2024, statistics show that nearly a third of card-holders have been hit by credit card fraud. With the average American making 23 card transactions each month (that's over 200…

YOUTUBE VIDEO: Financial Planning Thoughts for Gen Xers

In this video, I discuss how Gen Xers can simultaneously balance the financial pressures of supporting aging parents, children, and themselves. I share budgeting strategies and emphasize the importance of…

YOUTUBE VIDEO: 29 Great Movies About Money

In this video, I list a bunch of great films that are, in one way or another, about MONEY! When you have BIG money goals, it helps to watch films…

401(k) Vesting Explained: Don’t Leave Your Free Money Behind

In 2024, the average employer 401(k) match reached $3,500 annually, yet an estimated 23% of employees forfeit their match by leaving jobs before becoming fully vested. That's nearly $800 million…

YOUTUBE VIDEO: Quicken for Mac Tutorial: Settings Overview

Learn how to navigate Quicken for Mac with this tutorial on settings overview. I'll explain which settings should be turned on or off and WHY to help you understand the…

Comparing 15-Year vs 30-Year Mortgages for Homebuyers

Choosing between a 15-year and 30-year mortgage might seem like a simple numbers game, but this decision can dramatically shape your financial future. As a financial advisor who's helped countless…

Today’s Mortgage Rates and Home Ownership Decisions

The mortgage rate landscape in 2025 represents one of the most complex environments for homebuyers in recent memory. The Federal Reserve's recent 50 basis point rate cut signals a potential…

YOUTUBE VIDEO: How to File Your CA Statement of Information

In this video, I walk you through making either an initial statement of information filing or a renewal filing for your entity. I discuss the differences between filing it for…

7 Smart Ways to Boost Your Holiday Budget

The average American spends over $1,000 during the holiday season, creating financial stress for many households. While planning ahead is ideal, there are still effective strategies to build your holiday…

Why Home Ownership Still Makes Sense in Today’s Market

In today's housing market, aspiring homeowners face a challenging reality: the median home price has nearly doubled in the last decade, while interest rates continue to fluctuate dramatically. This leaves…

Moving Budget Tips: How to Save Thousands on Your Next Move

When I moved from California to Austin, I learned an expensive $12,000 lesson about moving costs. Like many people, I opted for what seemed easiest – a full-service moving company…

YOUTUBE VIDEO: S Corp vs LLC vs Sole Proprietorship – Which Do I Choose?

My clients frequently ask me, "What is an S Corp vs LLC and which one is best?" There's a lot of confusion surrounding this topic. First of all, a limited…

The Secret to Financial Growth: Best Saving Strategies Explained

In 2024, the average American spends nearly $3,381 each year (roughly $282/ month) on impulsive purchases, reveals a survey by Capital One. Unplanned spending thus makes up a staggering 21%…

YOUTUBE VIDEO: Small Business Financing Secrets (Loans, Credit & Leases OH MY!)

Looking for small business financing options? This video highlights 5 main financing methods AND how they affect your credit. We'll go into detail on SBA loans, working capital loans, revolving…

3 Proven Ways to Qualify for a Mortgage with Low Income

"Your income is too low for mortgage qualification." These words have crushed the homeownership dreams of countless aspiring buyers. But here's what traditional lenders won't tell you: there are proven…

W4 vs W2 vs W9 vs 1099 Tax Forms: What Are the Differences?

W4, W2, W9, and 1099 are all tax forms, but they serve very different purposes. Let's compare. W4 vs W2 vs W9 vs 1099 Summary FormW-4W-2W-91099What It's ForTells your employer…

YOUTUBE VIDEO: Financial Crimes Network (FinCEN): Beneficial Ownership Information Filing Walk-thru

In this video, I will walk you through filling out this new Financial Crimes Enforcement Network Beneficial Ownership form that you must fill out if you have an entity like…

YOUTUBE VIDEO: How to Create and Manage Your Business (Properly) – 11 Steps

Whether you're setting up a new business or want to incorporate yourself to save money, this video will guide you through 11 essential steps. I'll cover everything you need to…

All You Need to Know about Subprime Personal Loans

Kate’s 540 credit score was holding her back. After losing her job during the pandemic and dealing with an auto accident that required major repairs to her car, she struggled…

Easy Guide to The What, When, Why & How of Bookkeeping and Accounting

In a recent study, the American Institute of CPAs (AICPA) discovered that nearly 60% of Americans feel overwhelmed at the thought of managing their finances. Deciding whom to turn to…

Smart Savings Strategy: Multiple Retirement Accounts

Smart Savings Strategy: Multiple Retirement Accounts Consider that, if you have an annual income in the range of $65,000 to $70,000, proper structuring of your retirement accounts can easily save…

Master Money Management: Simple Tips For Achieving Your Goals

A 2024 survey found that one out of two Americans (51%) do not think they will have enough money saved when the time comes to retire. What's more, the deficit…

What Every New Entrepreneur Should Know About Business Finances

Imagine starting your dream business—an innovative idea, a clear vision, and all the passion to bring it to life. But as exciting as this venture is, your success depends on…

Are CDs a Smart Choice for Retirement Planning?

That’s the power of compounding. And it doesn’t even need you to make high-stakes investments. Certificates of deposit (CDs) combine the power of compounding with guaranteed returns, offering a secure…

Using Roth Conversions to Get the Most Out of Your Retirement Savings

Even the best-laid retirement plans can unravel when faced with unexpected tax burdens. Required Minimum Distributions (RMDs) are a prime example, forcing retirees to withdraw significant sums from their traditional…

Retiring in Scottsdale AZ: Pros, Cons, Costs & More 2024

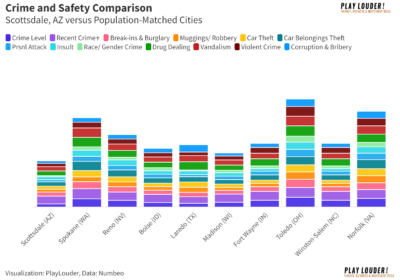

You're teeing off at a world-class golf course as the sun rises over the Sonoran Desert, painting the sky in hues of orange and purple. Is this a vacation fantasy…

How Risk Averse Are You? A Guide to Smarter Investing

First it was cryptocurrencies, then meme stocks, then NFTs. Back in 2021 it felt like everyone was taking enormous risks in the hopes of striking it rich. But even though…

Personal Capital Review 2024: Pros, Cons and Features

If you're looking for a tool that will give you Wall Street-like returns (without requiring you to live in New York), consider using Personal Capital. Created in 2009, Personal Capital…

Acorns vs Robinhood, Webull & M1 Finance: Best App in 2024

Are you looking to up your investing game? Do you want the stock market to make your money work for you? Are you sick and tired of sitting on the…

S Corp Filing Requirements by State: 2025 Update, 50 States

If you currently are a freelancer, sole proprietor, or independent contractor, you very likely could see some great tax benefits by switching to an INC or LLC that files its…

4 Acts to Unlock Early Financial Independence and Living Your Life

You're probably living your life in "3 Acts"---so were we. (This may sound a bit esoteric right now, but just bear with me.) When we finally realized that life was…

YOUTUBE VIDEO: How to Start an S Corp with Bizee (Formerly Incfile) rev

Learn how to start an s corp using Bizee (formerly Incfile) in this easy step-by-step tutorial. I'll reveal why I use Bizee, and clarify the most confusing aspects of the…

Retiring to Jupiter FL? 13 Facts to Know Before You Go

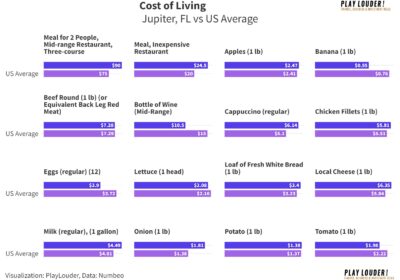

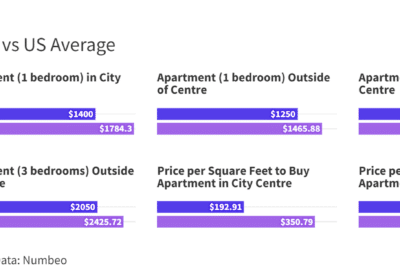

Jupiter, Florida: where golf courses outnumber traffic lights, and the Atlantic Ocean serves as your morning coffee backdrop. Tellingly, IRS data shows Jupiter's population growing 1.5 times faster than it's…

YOUTUBE VIDEO: Investing for Beginners: Understanding Risk Tolerance!

In this investing for beginners video, I'll demystify risk tolerance and help you understand why it is KEY to understanding how to invest in the market. I define risk tolerance…

YOUTUBE VIDEO: How to Start an S Corp with Bizee (Formerly Incfile)

Learn how to start an s corp using Bizee (formerly Incfile) in this easy step-by-step tutorial. I'll reveal why I use Bizee, and clarify the most confusing aspects of the…

Asset Protection Strategies: How to Safeguard Your Wealth

What do we mean when we say "Asset Protection"? To answer that, we first need to understand to what “assets” we are actually referring. Over the course of your life,…

60k a Year Is How Much an Hour? (And How Do I Budget for That Salary?)

60k a year is how much an hour? And how do you budget for a 60k salary? Let's find out. If you're a high school teacher, public relations specialist, zoologist,…

Retiring to Winter Haven: Pros, Cons & Costs in 2024

Imagine reeling in a trophy bass on a misty morning, then unwinding with lakeside yoga at sunset - not on vacation, but every day of your retirement. In Winter Haven,…