W4, W2, W9, and 1099 are all tax forms, but they serve very different purposes. Let's compare.

W4 vs W2 vs W9 vs 1099 Summary

| Form | W-4 | W-2 | W-9 | 1099 |

| What It's For | Tells your employer how much tax to take from your paycheck | Shows how much money you made and how much tax you paid | Provides your tax ID number to people who pay you for contract work | Shows how much money you were paid for contract work |

| Who Files | Employees | Employers | Independent contractors, freelancers | Businesses, clients |

| Who Gives It to Whom | Employers give it to employees to fill out | Employers give to employees and send to IRS | Clients or companies give it to contractors to fill out | Businesses/clients send to contractors and IRS |

| When It's Used | When employees start a new job or want to change how much tax is taken | Annually, by January 31 for the previous year | When you start working for a new client as an independent contractor | Annually, by January 31 for the previous year, for payments of $600 or more |

| What To Do With It | Fill it return to employer. Employees update yearly or when their tax liability changes (eg, marriage, having a child, buying a home, income changes, starting a side job, etc) | Keep it for your records. You'll need the information to file your tax return. You don't need to send it anywhere, but archive it in case of an audit | Fill it out and return it to the client. You only need to do this once for each client unless your information changes | Keep it for your records. You'll need this information to report your income when you file your tax return. You don't send this form to the IRS, but keep it in case of an audit |

| Actions for Employees/Freelancers | Fill out and return to employer. Update annually or when tax liability changes (e.g., marriage, having a child, buying a home, income changes, starting a side job) | Keep for personal records. Use information to file personal tax return. Archive in case of audit | Fill out and return to client. Update if information changes | Keep for personal records. Use to report income on personal tax return. Archive in case of audit |

| Actions for Employers/Clients | Provide to new employees. Use the information to calculate correct tax withholding. Keep completed forms on file | Prepare and distribute to all employees. Submit copies to the IRS. Keep copies for company records | Provide to new contractors. Keep completed forms on file for preparing 1099s | Prepare and distribute to all qualifying contractors. Submit copies to the IRS. Keep copies for company records |

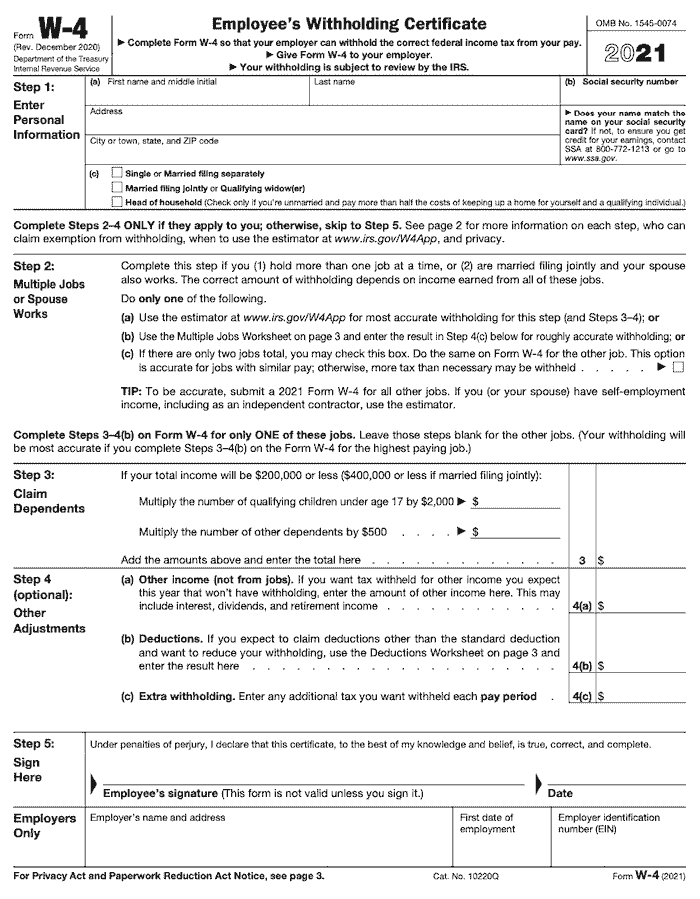

A W4 form (officially known as “Form W-4”) is what a full-time employee fills out for their employer when they start a new job. This form tells the employer how many deductions you will take when you file your personal tax return.

That information allows them to correctly determine how much they should hold back in taxes for you, which they send to the IRS on your behalf after every paycheck.

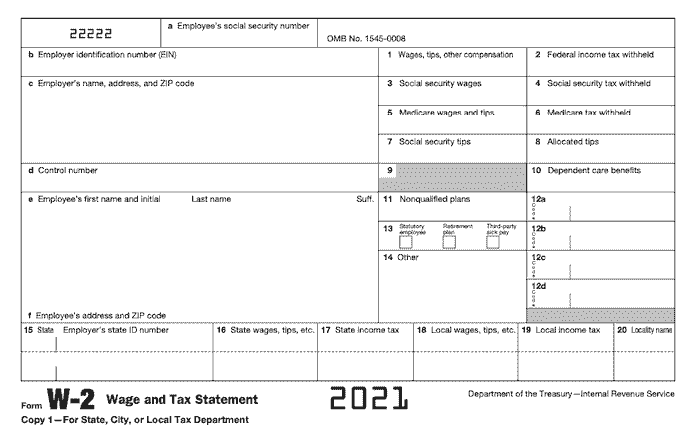

A W2 form (officially, “Form W-2”) is provided to the “full-time” employee by the employer at the end of the year so that the employee can file their tax return.

It summarizes the employees' wages for the year and how many tax dollars were held back and sent to the IRS on the employee's behalf. It also gets sent to the IRS, so they have an accurate record of this information.

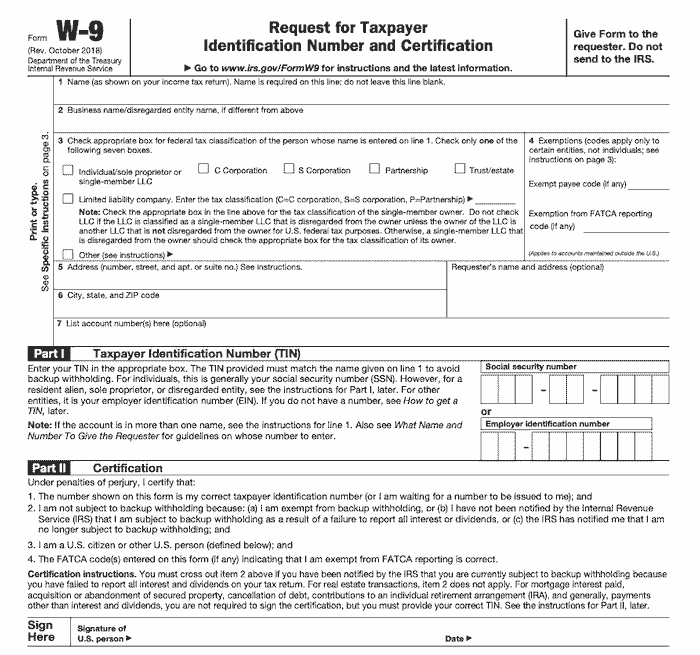

A W9 form (“Form W-9”), on the other hand, is filled out by a freelancer or independent contractor and then given to the company hiring them for their “independent” services. W-9s provide the employer with contact information and inform them on how they need to report any money paid to the IRS at the end of the year. Often, that year-end total gets reported to the contractor and the IRS via a 1099 form.

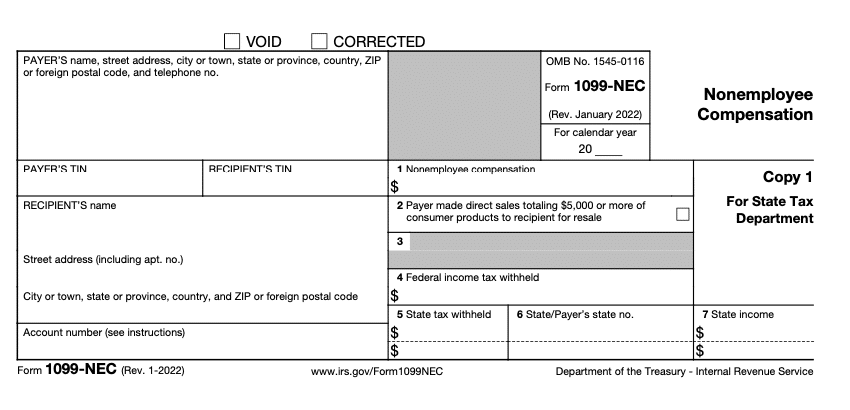

The 1099 form is what a company provides to an independent contractor at the end of the year. It summarizes how much the hiring company has paid the contractor.

This form is also sent to the IRS so they know how much the independent contractor received from the hiring company.

Related Article: W2 vs 1099 Pros and Cons: What are the Differences for Employers

Which Form Do I Need?

The form you use or need depends on whether you are a company's long-term employee or a short-term contract worker hired for a specific task or service.

If you have ever been an employee, you've likely received a W-2 at the end of the year from your employer. It's not something you fill out. The form shows how much you've earned and how much was deducted for taxes and contributed to retirement plans.

To further clarify requirements related to “full-time” employees, you will be asked to fill out a W-4 when you begin your employment. The W-4 is what tells the company how much tax they need to withhold from your regular paycheck and send to the IRS.

Conversely, if you're self-employed as a freelancer or independent contractor, you will not receive a W-2 at the end of the year. Instead, you'll get a 1099.

Your taxes will not be taken out of your pay for you and sent to the IRS on your behalf. You need to calculate your own payroll taxes and then submit the sum to the government (usually with the help of a CPA).

If you are a business owner reading this and want more information about filling out and filing 1099s, you could check this guide on filling out a 1099-NEC form.

So when does the W-9 form come into play? Well, this is the form a freelancer or independent contractor fills out to give their clients important tax information (like the taxpayer identification number).

How do you differentiate between an employee and an independent contractor? Sometimes this can be confusing for both the employer, who's trying to be a responsible business owner, and for the worker themselves. The rules around this also vary a little between states.

Read on to learn more about the W-9 and the W-2 and how to distinguish between an independent contractor and an employee.

More detail on the W-2

Let's start with the most common IRS form and one most employees receive at the end of each working year. The W-2 form is the form created for an employee by an employer.

It shows the IRS information about the money they have made over a year and what taxes they have paid.

The W-2 is used for employees who work for an employer consistently and for whom the employer is responsible for deducting taxes and paying them to the IRS. This applies to workers who are referred to as “full-time” employees.

The W2 form contains the following:

- Personal contact information from the employee

- Employer name and information

- EIN or the Employer Identification Number (which is how the IRS knows the company)

- Deductions

- Contributions

- Salary and bonuses

Deductions are based on the W-4 form the employee completes upon being hired. The W-2 form is needed to file taxes for tax returns each year.

More detail on the W9 Form

A W-9 form is filled out by independent contractors and freelancers and then given to the company hiring them.

The W9 form contains the following:

- Personal contact information

- Company name if they have an entity

- Contractor's social security number or Employer Identification Number (EIN) if they have an entity

Let's say you, as an employer, hire a general contractor to work with your business on a project for two weeks.

You are technically employing or hiring the contractor. Yet, independent workers will be responsible for paying their taxes to the IRS and the state.

Still, the IRS wants you to report how much you paid this worker.

This is why the contractor must provide the W-9 form to you. In the form, they should include their contact information and Employer Identification Number (EIN) or social security number.

This connects the independent worker's information to the IRS, and the employer can then report how much was paid to them for the work done.

Employee vs. Independent Contractor: When You Are the Worker

As a worker, it's essential to understand when you are an employee and when you are a contractor.

As an employee, you have an employer responsible for taking taxes from your wages and paying them to the IRS on your behalf. However, as a contractor, though you are getting paid by someone else, you are responsible for sending the taxes on those wages to the IRS yourself.

The IRS uses a set of criteria known as “the 20 factors common law test” to determine whether an individual is an independent contractor or an employee. Under this test, the IRS considers several factors, including the relationship a contractor has with a business, behavioral and financial control, and some other factors.

It is important to note that the IRS will consider the entirety of the relationship between the employer and the worker to decide whether they need you to fill in a 1099 vs a W2 tax form. If an individual is classified as an employee, the employer fills in a W2 form, and if they are classified as a contractor, the employer must file a 1099 form.

Often, as an employee, deductions will be automatically taken from your pay. They may go towards insurance benefits or a retirement account, like a 401K. The employer does this for you.

Conversely, you don't have someone doing this for you as a contractor or independent worker. It becomes your responsibility since you are technically self-employed.

That said, many contractors become their own businesses or corporations. Then they can seek tax benefits for themselves and their business.

As an employer, you decide who you hire and in what capacity. You employ certain people to come to work every day and perform regular functions that keep your company running.

These employees go on your payroll. That means you are responsible for sending the employees' taxes to the state and IRS on their behalf each quarter. Additionally, you'll need to provide each employee and the IRS with a W-2 form at the end of the year.

Sometimes you only need hired help for a short period or a particular project. In this case, you might hire someone as an independent contractor or consultant but not put them on the payroll.

You won't be responsible for sending the state or IRS their taxes in this case. You also won't have to pay the “employer” portion of payroll taxes. They will have to cover that, which will save you more.

Navigating the maze of tax forms can be daunting, but understanding them is crucial for managing your finances effectively. Our courses offer a deep dive into financial planning and management, providing you with the tools to make informed decisions about your taxes, investments, and business strategies.

But what exactly entails a freelancer vs. an employee?

Some companies may try to pay more workers as “freelancers” because they want to avoid paying employment taxes, workers' compensation, etc. The line can be blurry sometimes, and you certainly don't want a lawsuit (such as when Uber had to pay out $100 million to New Jersey).

So let's compare the main differences.

The following table provides a comprehensive overview of the key distinctions between employees and independent contractors/freelancers. It covers various aspects such as work control, financial responsibilities, benefits, tax implications, and more, helping to clarify the nature of these different working relationships.

| Characteristic | Employee | Independent Contractor / Freelancer |

| Work Control | Employer controls when, where, and how work is performed | Has control over when, where, and how work is performed |

| Financial Control | Employer provides tools, supplies; reimburses expenses | Responsible for own expenses; invests in own equipment |

| Relationship Type | Ongoing, often indefinite employment | Project-based or defined contract period |

| Benefits | Often receives benefits (health insurance, paid time off, etc.) | Does not receive employee benefits |

| Tax Withholding | Employer withholds income tax, Social Security, and Medicare | Responsible for own tax payments, including self-employment tax |

| Right to Terminate | Can be terminated at will (unless contract states otherwise) | Bound by contract terms; early termination may have consequences |

| Multiple Clients | Typically works for one employer at a time | Often works for multiple clients simultaneously |

| Training | Receives job-specific training from employer | Expected to have necessary skills; minimal client training |

| Integration into Business | Work is essential to core business operations | Provides specialized services not core to client's business |

| Profit/Loss Risk | No direct profit/loss risk; paid regardless of company's profit | Bears risk of profit or loss on each job |

| Primary Tax Forms | W-4 (upon hiring), W-2 (annually) | W-9 (upon engagement), 1099 (annually) |

Employee

If you hire an employee, they:

- have assigned hours and a set schedule

- get company training

- have an overseeing manager that assigns work and controls what the worker does and how they do their job

- they do work that is part of the regular business and integral to its functioning

- use computers and other materials provided by the company

- are only be employed by you

- have a regular guaranteed salary

Independent Contractor

If you hire a freelancer or independent contractor, they:

- will not be tied down to certain working hours

- do not always have to be onsite

- will not need company training

- can turn down work or certain tasks

- are employed by other companies

- provide their materials

- get paid on a per-job basis

- generally provide services that are outside of what the hiring company provides

Understanding W-4 vs W-2 vs W-9 vs 1099 Tax Forms

Understanding the W-4, W-2, W-9, and 1099 forms is important for both employers and employees come tax time. It's also worthwhile for both to consider which makes the most sense for them to pursue regarding their companies.