In the past, the most common type of work was 9-5 work, where employees would work a set schedule for big corporations. With the explosion of the gig worker economy and freelancing, the societal scene is starting to shift.

If you currently own a business, getting familiar with the various types of workers is a good idea, as they have different tax obligations depending on your hire. Two of the main types of workers are ones that need W2s and ones that need 1099s. This post will cover W2 vs 1099 Pros and Cons and some of the key differences between the two.

What is a W2, and Who is it For?

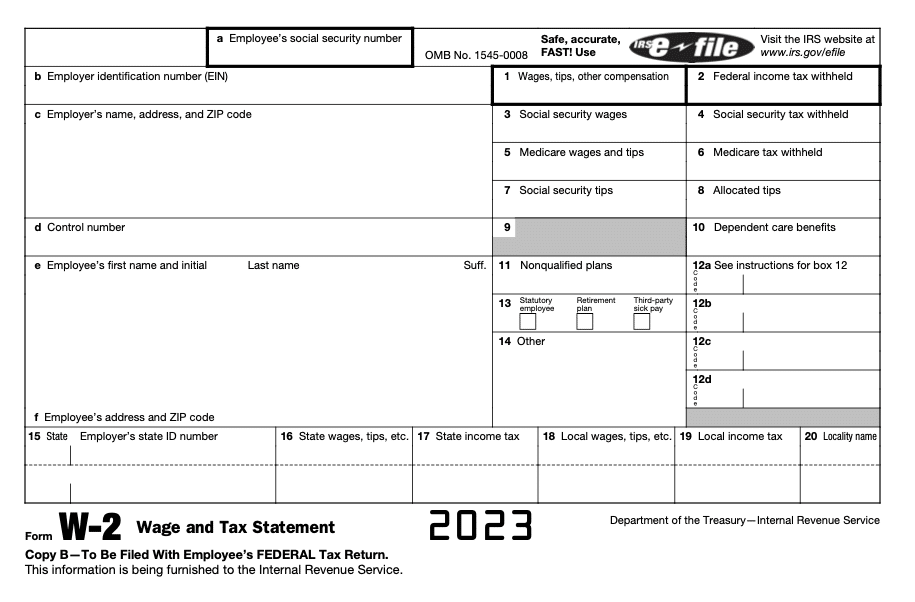

A Form W-2, or W-2 tax form, is an IRS tax form that records how much income an employee made throughout the year and their benefits and taxes. It's a form that records wages paid to employees and taxes withheld from employees throughout the year. The form will contain basic information like employer/employee addresses, an employee social security number, and EIN (Employer Identification Number).

As part of the employment agreement with full-time and part-time employees, employers must fill out and send this form to workers at the end of the year. Employees will then take this form to file their year-end tax returns. On top of wages, the W-2 form will also show the amount that both employees and employers paid for 401(k) plans, HSA contributions, and healthcare.

W2 workers are employees who are full or part-time at the job. However, because the company fully employs them, employers must also pay a larger chunk of their FICA tax, FUTA, and SUTA.

FUTA and SUTA both relate to unemployment compensation (if the employee gets let go), and FICA is related to Medicare and Social Security taxes. Paying these taxes is done through your payroll provider, which generates your employee paychecks and paystubs. Other services, like a duplicate pay stub generator, can also help facilitate tasks.

Pros of a W-2

Greater Control

One of the main benefits of hiring W-2 employees is how much control employers have over them. Hiring a W2 employee, you get to dictate their hours, training schedule, and daily tasks. This fact can be highly beneficial if you're looking for someone to complete an essential duty in a specific way.

Regarding the traditional employee side, some W-2 workers prefer stability and a set job schedule. Generally, a W-2 worker will have more of their working life dictated by the employer.

Longer-Term Solution

If an employer has a task that takes a long time to complete and requires a high level of commitment, hiring a W-2 employee could be a smart move. W-2 employees are fully employed and, as such, are hired for an indefinite amount of time. This benefits employers as they will constantly have team members to delegate tasks.

For employees, this can also be a plus as they are offered job security and a constant source of income.

Benefits

W-2 employees are typically taken care of by companies much better than 1099 workers. Employers usually offer certain regular employee benefits like contributing to a retirement plan, providing health insurance, and paying for sick leave.

These are all rare to come by for 1099 workers, as they usually work on a project-by-project basis.

Cons of a W-2

Cost

Employers need to pay for certain extra benefits, which will ultimately cost them more—adding up the training required to get new employees up to speed, the health insurance they'll need, and all the tax contributions.

Time Commitment

Employers usually need to spend much more time training W-2 employees than just hiring a 1099 contractor. On top of that, employees typically need to work a standard 9-5 or 8-5 job, meaning they have less freedom in their day-to-day life. In addition, some employees can feel trapped by this rigid work schedule.

More Liability

Since employees have more protection than contractors, employers must work extra hard to get them the legal protections they need.

This includes paying payroll taxes and unemployment taxes, providing unemployment insurance, and providing certain disability benefits.

What is 1099, and Who is it For?

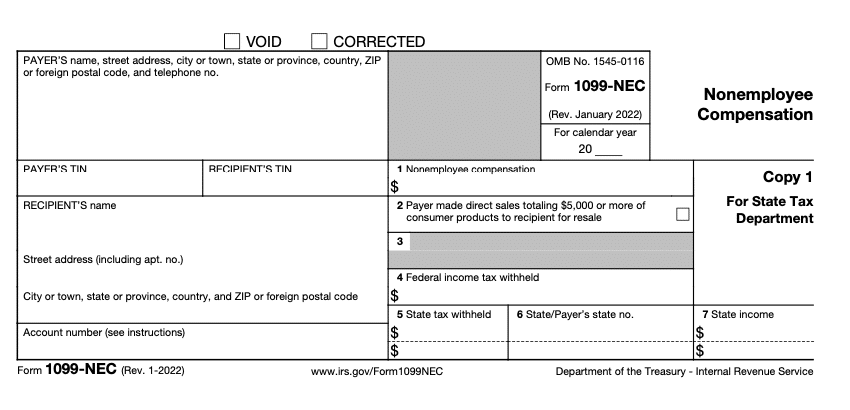

Employers use Form 1099-NEC to record an independent contractor's earnings. In the same way, the IRS uses the W-2, the 1099-MISC form informs the IRS of how much a company paid a contractor. Companies must file a 1099 form if they spend over $600 on a contractor (wages, rent, or health care payments).

Contractors are otherwise known as freelancers, consultants, or even small business owners. The IRS categorizes them as “self-employed” and can be found in various professions. For example, a 1099 contractor could be a pricey lawyer hired for a one-time legal case or a low-earning freelance writer for a website.

Contractors usually have greater control over their time but also suffer from more risk. They don't receive employee-type benefits and are responsible for paying their taxes. That being said, contractors also have a few perks to help them out, including deductions. You can deduct certain business expenses to help with your taxes as a contractor. These are typical expenses related to small businesses and can include home office expenses, meal expenses, and even portions of rent (if you work at home).

Pros of 1099

Cheaper Work

Because 1099 contractors are not full-time employees, employers don't need to pay them as much in benefits or reimbursements. This can be beneficial as employers no longer need to worry about FUTA and SUTA taxes for contractors (and also don't need to worry about FICA).

Greater Freedom

One of the biggest benefits to both employers and workers under the 1099 system is how much freedom both enjoy. Workers can dictate their schedules, set higher rates, and have a greater work-life balance than if they were W-2 employees. Oftentimes, many W-2 employees switch out of their jobs and start freelancing for this very reason.

For employers, greater freedom is beneficial as they are not overly committed to the worker. If employers are unsatisfied with a freelancer, they don't need to go through the troublesome process of firing them and can just choose never to hire them again. Furthermore, employers don't need to provide overtime pay or workers' compensation to freelancers as they are hired on a project-by-project basis.

Niche Skills

A 1099 worker can be a great option if an employer is looking for someone to complete a specific task or specific project, but one that doesn't come up often. A great example is a firm hiring a lawyer for legal issues when they come up. If a company gets sued, it needs to attend to the issue, but it's unlikely that they want to hire a lawyer full-time (unless they have legal issues often). In this case, a 1099 worker could be perfect as they can be hired on a one-time basis, do their job, and leave.

For contractors with unique skill sets, this can be an advantage too. Many freelancers can charge a lot just because there aren't many people available on the job market that can fulfill a niche as narrow as theirs.

Cons of 1099

Less Stability

This can be a serious disadvantage for employers who like to have much control over their employees. Contractors typically work whenever they want and require very little supervision. This can mean that it's hard for employers to tell them how they want the project completed.

For contractors, freedom is usually stated as a positive, but it also means they can be terminated on short notice. This means that as a contractor, you must constantly look for your next job. Unlike an employee, a contractor takes full responsibility for how much they are earning. If they don't do the work, no money will flow in.

Weak Relationship

Though a company can hire some contractors for a long period, they are usually treated and work very differently from typical W-2 workers. Independent contractors are independent workers who usually work their hours and rarely come to the office, meaning they don't have as many chances to build strong relationships with their employers and other employees.

This can be hard on employers who want to build stronger bonds and greater worker morale with contractors and tough on contractors. Though contractors do have the freedom to control their working schedule, some find that life can get a little lonely sometimes.

Seasonality

With W-2 employees, even if they are not needed at a specific time of year, employers will generally not choose to fire them, as the costs and hassle are usually too high. However, for 1099 contractors, this is not an issue as they work on a project-by-project basis. This means that if independent contractors work in a very seasonal business, they can find it hard to make money during some parts of the year.

An example of this is accountants. Typically, accountants are needed most during tax season. This time of the year is when demand is the highest, and they have the greatest opportunity to earn money. As an accountant contractor, you can potentially make lots of money during this period. That being said, as soon as tax season ends, you might struggle to find work.

Recap: W2 vs 1099 Pros and Cons

Nowadays, more and more workers are shifting how they live their lives, including how they complete their work. One of the most significant distinctions between workers is whether they get filed a W-2 or 1099 form. As an employer (and an employee), it's important to know the difference and the various pros and cons of each.

This post has provided a clear overview of just what a W-2 form and a 1099 form are and listed some of the main pros and cons of each one. Each kind of worker is unique in the way that the IRS views them and in the way that employers treat them. Knowing the key differences will give you the knowledge you need to venture into the new and ever-changing economy and deal with every type of worker.