Do the anxiety-inducing questions, “How can I manage my finances better?” and “Where do I even begin?” constantly plague your thoughts? You're not alone. More than half of Americans are now living paycheck to paycheck.

Fortunately, even if you feel completely overwhelmed, financial stability is achievable.

In this guide, we'll explore ways to tame your money monster – from cultivating a positive mindset about wealth to setting achievable financial goals.

We’ll uncover how an emergency fund can serve as your safety net during hard times and discuss the significance of understanding credit scores in managing debt effectively.

We won’t stop there; investing wisely for future goals and budgeting will also be addressed.

Ok, are you ready to start mapping out your path to prosperity? Let's dive in!

Table Of Contents

- The Importance of Personal Bookkeeping

- Building a Money Mindset

- Setting Financial Goals

- Budgeting: Your Ticket to Healthier Money Habits

- Building an Emergency Fund: A Pillar of Financial Stability

- Managing Debt and Understanding Credit Scores: A Comprehensive Guide

- Building Your Financial Future: Saving and Investing

- Three Steps to Secure Your Retirement

- Additional Money Management Tips

- FAQs in Relation to How Can I Manage My Finances

- Conclusion

The Importance of Personal Bookkeeping

First, let's address the most important hurdle to getting started….Bookkeeping.

When it comes to personal finances, I always remind my clients, “You are running the Business of You!” Bookkeeping is essential if you don't want the “Business of You” to fail.

No matter how much you want to believe otherwise! There's just no way around bookkeeping.

Bookkeeping involves recording all financial transactions, tracking income sources, identifying expenses, and analyzing cash flow patterns.

With accurate bookkeeping records, you can make informed decisions about investments or cutbacks that may be necessary.

Your Financial Data as a Decision-Making Tool

Your financial data serves as a powerful tool when making important fiscal decisions.

Here are some examples of how financial data helps you manage your finances:

- You actually know if you spent more money than you made in a given period. This is what determines if you get to invest money for your future or if your debt hole just got bigger.

- You can identify the areas of spending where you have the biggest overspending issues.

- You identify areas of spending that you thought were much less than they actually are.

- You can learn whether or not you are saving enough every year to reach financial freedom (and how quickly you can get there).

- You can very easily take a monthly average to assemble next year's budget.

In a broader sense, all of this information helps you identify net results, spending habits, quality income sources, and a host of other stats that enable you to better run your financial life.

Use Software To Track Your Finances

In the realm of personal finance and small business management, keeping a meticulous record of your financial data is paramount. This not only helps you stay organized but also informs your decision-making process.

One effective way to achieve this is by using software to track your finances. A relatively small investment in the appropriate software can have a substantial positive impact on the health of your finances.

How To Choose the Right Personal Finance Software

There are myriad options on the market to choose from. Here is a rundown of the most popular current software.

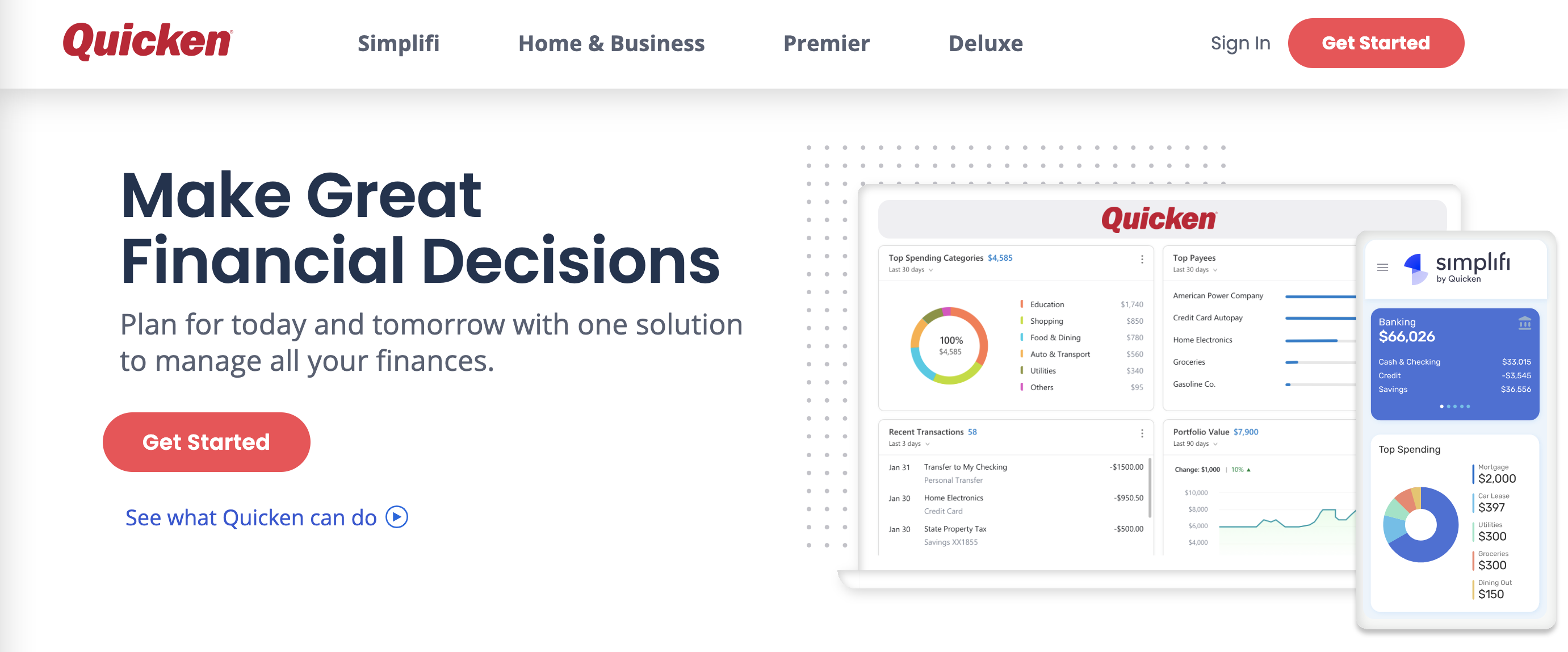

Quicken

Quicken is one of the oldest and most comprehensive financial management tools out there. It offers robust features that cover everything from budgeting to investment tracking.

Quicken allows for long-term planning, giving its users the best bang for their buck. Some argue that it is expensive, but with its provided features, you can save money by thinking smarter about your finances.

Its ability to import transactions directly from your bank makes it convenient for users who want an all-in-one solution for their financial needs.

Features

- Manages your account balances, investing, personal budgeting, and loans.

- Monitors the performances of your brokerage accounts extremely. It has transactional level detail for brokerage accounts, providing data as good as your brokerage website. But it's better because it can combine all your accounts into one view.

- The home and business version allows you to incorporate your business accounts and have A/P & A/R. Your invoices can get paid by credit card as well!

- The home and business version also has a real estate management component. It offers a full suite of functions to manage your real estate and rental property portfolio.

- Basically, Quicken does more than any other software I have been able to find.

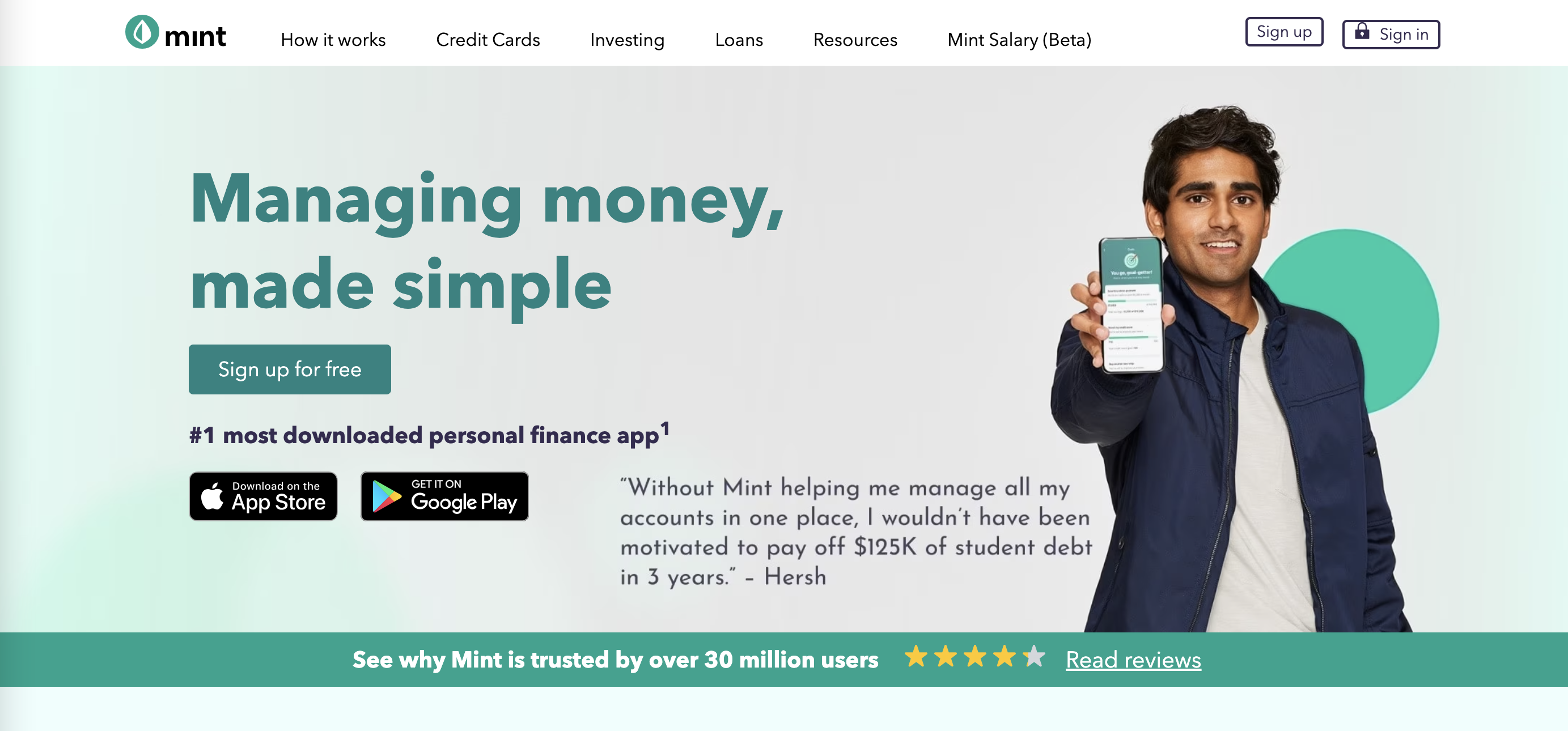

Mint

If you're looking for a user-friendly budgeting tool, Mint might be what you need.

This free-to-use platform updates your spending habits and offers personalized tips to improve your savings goals.

Plus, its mobile app lets you manage your money on the go!

Mint is mainly directed at personal budgeting on a smaller scale.

Features

- It pulls all personal financial information into one location providing an overview of current finances.

- Provides alerts to the user if too much is spent on ATM fees, budget is exceeded, if a bill is due soon, or suspicious account activity is detected.

- Most of Mint’s users are mobile and it's easy-to-use interface makes for a great experience.

Moneydance

In the personal bookkeeping software game, Moneydance would be considered Quicken's primary, if not somewhat lesser-known competitor. On the market for over 20 years, it matches all of Quicken's features with a few extras of its own.

It's particularly useful in foreign exchange transactions and uses handy visual displays to represent the current state of your finances.

Features

- Tracks the personal finances of each user.

- It provides online bill pay services.

- They support multiple currencies, including cryptocurrencies.

- Provides strong security for its users.

- Capable transaction management, such as budgeting.

- Moneydance handles investment tracking and reports.

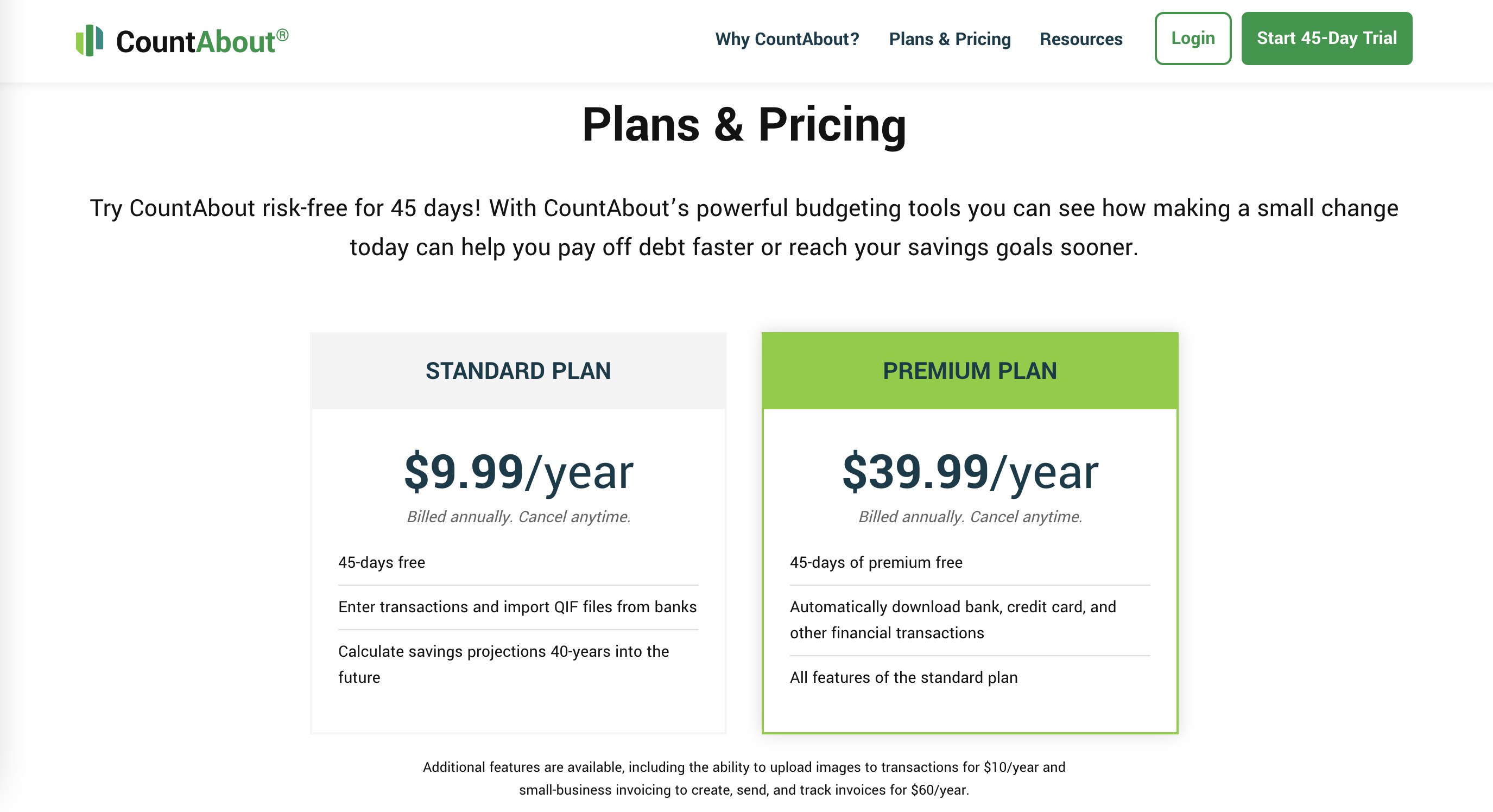

Countabout

Last but not least is Countabout, a customizable personal finance application compatible with both Quicken and Mint data imports. It's a perfect choice if you're transitioning from either platform!

CountAbout's features include budgeting, reporting, and investment tracking, all in the Cloud.

With no software to install, it is anywhere you have an Internet connection. Their platform is stable, secure, and totally private.

Another key distinction is that CountAbout is a completely advertising-free experience. Of course, to make that possible, there is an annual subscription cost.

Features

- CountAbout can import Mint and Quicken data into its own software.

- Provides excellent transaction tracking.

- Includes customizable categories and tags.

- Supplies its users with good recurring transaction options.

Building A Money Mindset

A positive attitude towards money is not just about having enough to pay the bills. It's about developing an empowering perspective on personal finance, where you see resources and opportunities as abundant rather than scarce.

The process of building this strong money mindset, much like constructing a house, starts with laying down the foundation – your beliefs and attitudes about wealth.

Managing money effectively isn't just for accountants or financial wizards; everyone can do it. And it all begins by reminding yourself of the abundance around you daily.

Overcoming Limiting Beliefs About Money

We all have our own stories when it comes to money. Some might think “Money doesn't grow on trees,” or “I'll never be wealthy.” These limiting beliefs often serve as roadblocks in achieving financial success and need to be confronted head-on.

You don’t have to let these negative thoughts control your life anymore. Instead, replace them with more positive affirmations such as “Wealth flows easily into my life.” This kind of mental shift helps rewire your brain’s neural pathways, fostering healthier views around accumulating wealth over time.

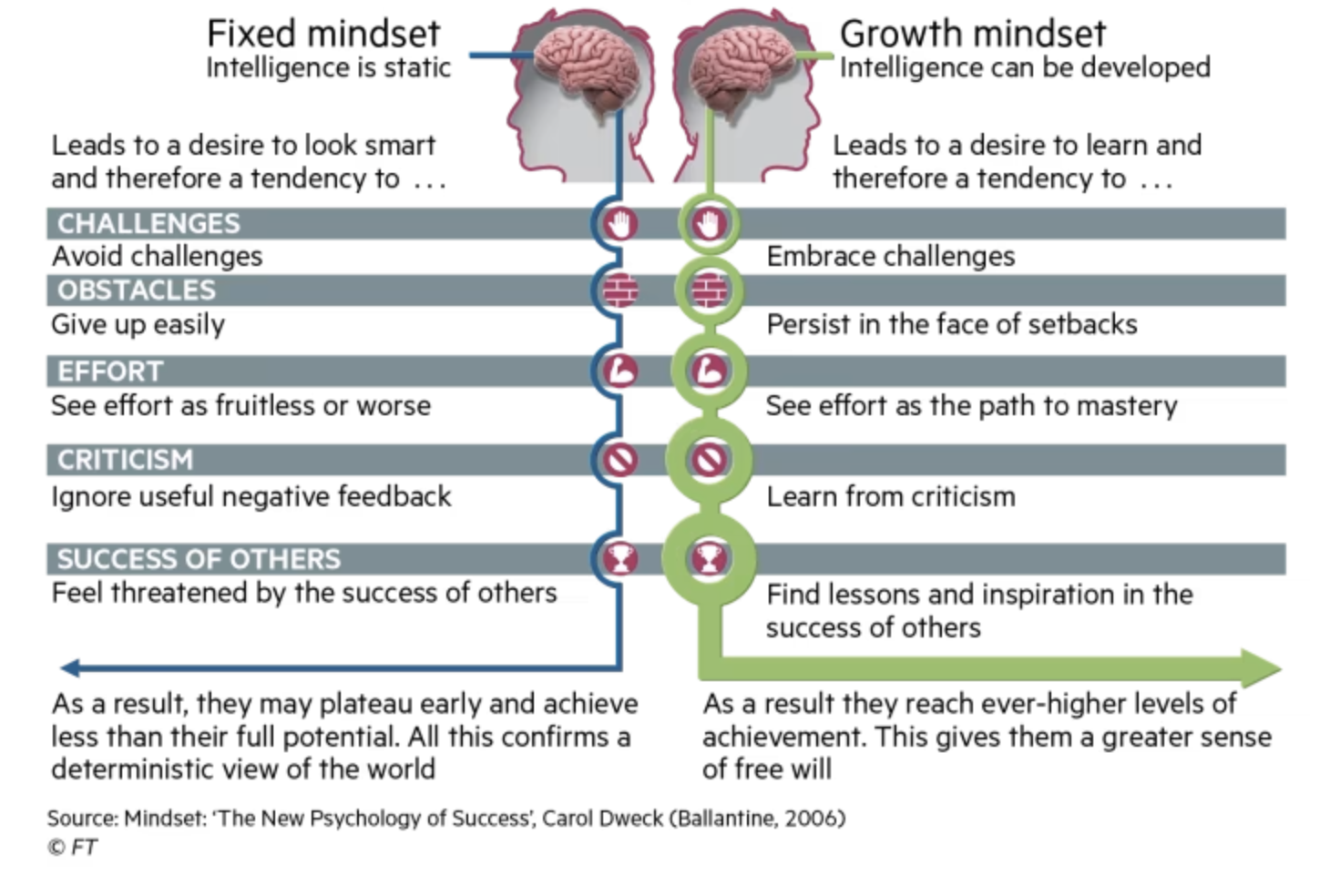

This positive mental shift is called a growth mindset, and research shows that it is key to financial success.

The same is true for any positive habit, whether you want to quit smoking, eat a healthier diet, or get better with money. To see any point in trying, you must first believe the outcome is attainable. You have to think your effort will yield results, that the sacrifices will be worth it, and that dedication and hard work will take you where you want to go.

In other words, you need a growth mindset.

But to cultivate a strong bond with money, we must alter our views as well as our behaviors.

Making Practical Steps Towards Financial Success

Taking practical financial management steps is also crucial to complement these mental shifts. Whether that means creating an effective budget plan or exploring investment options depends entirely on your individual circumstances and goals. The important thing here is action – making changes that move us closer to our financial dreams.

Acting on goals could involve establishing a savings account, investing in stocks or real estate, launching an enterprise, or even just studying more about finances. The key is to start somewhere and then keep going.

Key Takeaway: Building a positive attitude towards money goes beyond just settling the bills. It's about embracing abundance, not scarcity. Let go of outdated notions such as “money doesn't grow on trees” and adopt empowering affirmations like “wealth flows easily into my life.”

Remember, handling your finances isn't some mystical art – it's something everyone can master. So start taking proactive steps today.

Setting Financial Goals

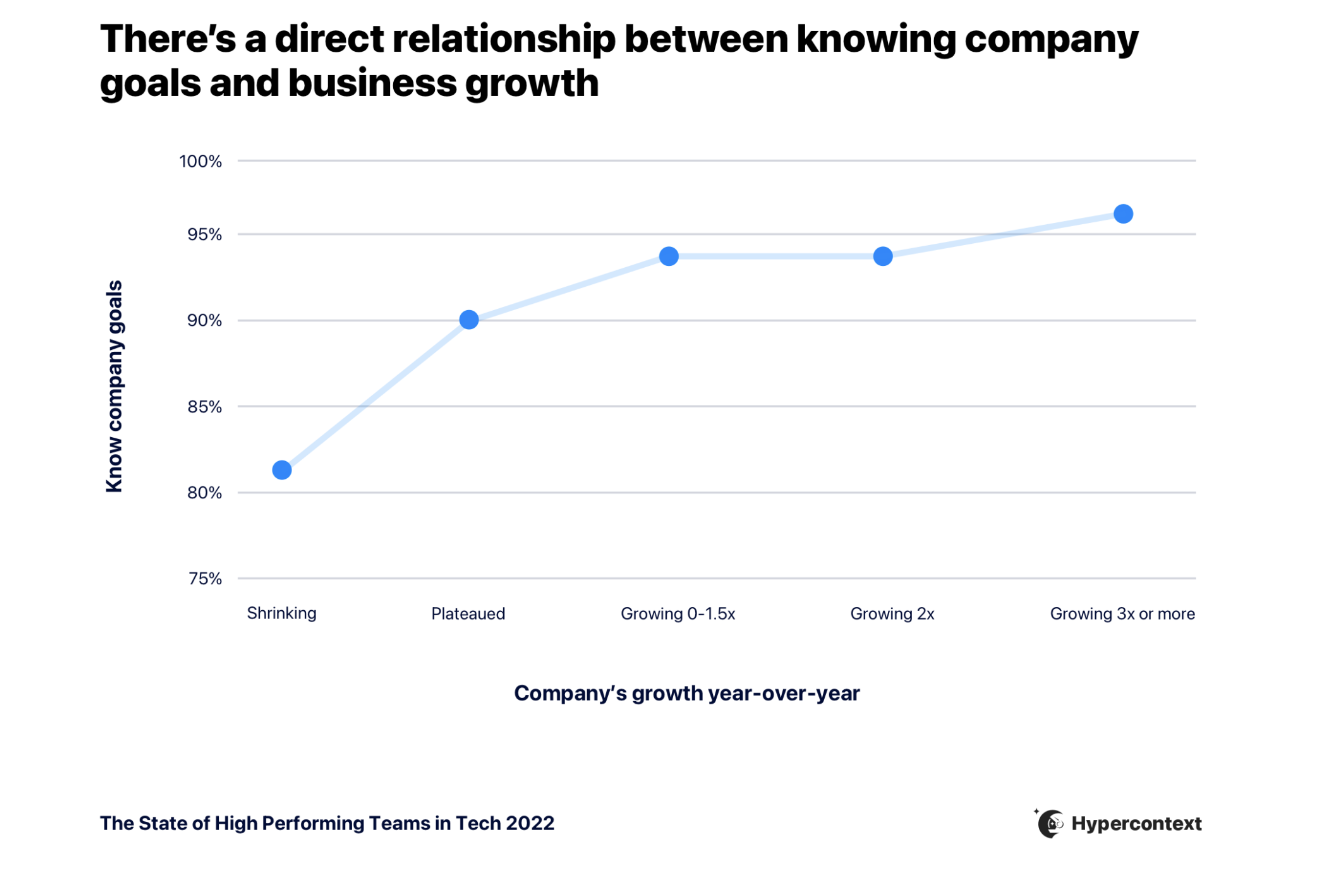

Research shows that goal setting is directly correlated to financial success.

Setting financial goals involves identifying what you want to achieve financially within a specific time frame. This could be anything from saving for retirement, buying real estate property, expanding your business operations or increasing the value of your investment portfolio.

Here's how to get started:

A. Define Your Goals

Your first task should be defining what exactly are your financial objectives. Are you planning on saving up for retirement and accumulating wealth through investing in stocks or real estate? Or perhaps you aim to expand your small business into new markets?

Once these questions have been answered with precision and clarity, it becomes easier to formulate strategies to achieve these targets.

B. Make Your Goals SMART

To increase the chances of accomplishing these aims successfully, make sure they are SMART:

Specific (clearly defined)

Measurable (can track progress)

Achievable (realistic given resources available)

Relevant (aligned with overall life/business/investment strategy)

Time-bound (have set deadlines)

Clarity in your goal-setting provides the motivation and focus you need to succeed.

A goal like “I want to save $100k by 2025” is much more effective than just saying, “I want to save money.”

C. Create Action Plans

After establishing SMART goals comes creating action plans – concrete steps that need to be taken towards realizing each objective. These might include creating budgets, starting investment portfolios, or developing business expansion strategies.

If big-picture targets like retirement seem too daunting right now due to other commitments or circumstances – don’t sweat it. Start with smaller objectives, such as creating an emergency fund or paying off credit card debt first.

Just make sure each goal has a deadline attached. Otherwise, there won't be enough urgency to achieve them on time.

D. Regularly Review and Adjust Your Goals

Finally, remember that setting financial goals is not a one-time event but rather an ongoing process requiring regular reviews and adjustments as circumstances change.

The journey toward effective finance management begins with clearly defined financial goals that guide your saving, spending, and investment decisions. So, set those targets today!

“Many people fail in life, not for lack of ability or brains or even courage but simply because they have never organized their energies around a goal.”

— Elbert Hubbard

Budgeting: Your Ticket to Healthier Money Habits

In personal finance management, budgeting takes center stage. It provides insight into how our earnings are allocated and, over time, fosters healthier money habits.

A deep dive into your current financial situation is where it all starts. You must examine your monthly income, gross income, and monthly expenses. By doing so, you will identify spending habits that might be stalling your progress toward savings goals.

An effectively crafted budget ensures there are adequate funds for necessities (like rent), wants (think entertainment costs), and future dreams while keeping unnecessary expenditures at bay.

What Is a Budget?

A personal budget is a spending plan. It shows you what you will have left after you take your income and subtract all your expenses each month.

To create a budget, you need to break down all of your spending categories to clearly see your spending habits and where you might be overspending.

Budget apps can come in handy here – they keep track of monthly incomes and expenses, ensuring you're on track towards reaching your financial aspirations.

Creating a budget is indeed a crucial step in developing healthier money habits. It's all about striking the right balance between current needs and future aspirations without any financial stress.

Impacts of Financial Stress on Budgeting Abilities

Financial stress isn't just about numbers; it also affects one's ability to budget effectively. The strain often leads individuals towards impulsive spending habits rather than focusing on paying bills promptly, which is crucial in reducing outstanding debts.

- Mental Health: According to the American Psychological Association, financial stress directly influences our budgeting abilities, leading us down a path where we might find ourselves buried under piles of unpaid bills, including those from credit cards or student loans. This persistent pressure can also have negative impacts on overall mental health.

- Budget Planning: Creating a realistic monthly budget that accounts for all expenses – necessities like rent/mortgage payments as well as discretionary items such as entertainment costs – could mitigate these impacts significantly.

- Prioritizing Debts: Prioritizing high-interest debts first may assist in managing your finances better by saving money over time through reduced interest charges.

Key Takeaway: Start making your money work for you. Dive deep into your finances, set goals with timelines, and embrace budgeting. Your ticket to financial freedom is just a few smart steps away.

Building an Emergency Fund: A Pillar of Financial Stability

In the world of personal finance, having a buffer for unexpected expenses is not just about security. It's also about peace of mind and stress reduction.

An emergency fund, as it's often called, can be that much-needed cushion.

Setting aside funds specifically for emergencies offers invaluable financial stability during unforeseen circumstances.

A safety net isn't just for trapeze artists; everyone needs one to catch them when life throws curveballs. These things happen, whether it’s sudden medical bills or unexpected car repairs. And they can cause significant financial stress if you're unprepared.

Many financial experts agree that having at least $1,000 in an emergency fund helps alleviate money-related stress.

Kickstarting Your Emergency Savings

If this concept is new to you, don’t fret. You don't need a fortune to start your emergency savings. The key here is consistency over time.

Here are some tips:

- Budgeting carefully and saving small amounts regularly will gradually build up your emergency fund.

- Saving windfalls like tax refunds or bonuses can boost your savings (45% of Americans do this).

- Making automatic transfers from your paycheck into the designated account ensures consistent growth without much effort on your part.

Growing Your Reserve Over Time: From Buffer to Fortification

Starting with a small goal like $1,000 is great. But don't stop there. Aim to build a reserve that could cover at least three to six months of living expenses.

This will provide substantial protection during extended periods of financial stress, such as job loss or severe illness.

Key Takeaway: Stuffing away a little cash regularly into an emergency fund is like padding your financial trapeze net – it's not just about safety but also peace of mind. Start small and be consistent; every bit helps. As the pot grows, your stress reduces. Remember, you're prepping for those curveballs life occasionally throws.

Managing Debt and Understanding Credit Scores: A Comprehensive Guide

The realm of personal finance is a labyrinth, with managing debt and understanding credit scores at its core. Navigating this maze effectively requires strategies to avoid falling into the trap of unnecessary debts such as credit card debt or student loans.

“Paying more than just the minimum on your credit cards can make a significant difference in reducing both your total amount owed and the time it takes you to clear off this type of card debt.”

– An Expert from the National Foundation for Credit Counseling

In essence, tackling high-interest debts first could help manage finances better by saving money over time through reduced interest charges.

Pay off Costly Credit Card Debt

Addressing high-rate debt is one of the most effective investment strategies you can undertake. The sheer cost of maintaining an outstanding balance with such a high interest rate creates a drain on your resources that could otherwise be put towards investments or growing your business. Investopedia, an online resource for finance and investing information, confirms this strategy by suggesting paying off debts as quickly as possible.

With banks offering less than 1% interest on savings accounts, it starkly contrasts the average 17% they charge for unpaid credit card balances. This discrepancy can be a significant roadblock when trying to build financial security.

Leveraging Balance Transfer Deals

If you have maintained good credit, there are options available that may help alleviate some of this burden. One such option is investigating if you qualify for a balance transfer deal. These deals typically involve moving your existing balance from one card onto another new one, which offers an initial period where no interest payments are required.

- Avoid Interest: Not having to pay any interest during this introductory period allows more of your repayments to go directly toward reducing the principal amount owed rather than just covering accruing interest charges.

- Create Repayment Momentum: This window provides time in which making substantial headway in repayment becomes feasible without additional compounding factors like ongoing interests piling up. CreditCards.com provides a comprehensive guide on how to make the most of balance transfer deals.

The Importance Of A Good Credit Score

A good credit score isn't just a number; it's the key to financial freedom. Lenders often consider this a crucial factor when you apply for loans or credit cards, with higher scores usually translating into lower interest rates and better terms.

You need to take your credit score very seriously because it's the key to so many financial aspects of your life. It will determine if you can buy a house, or a car, start a business, and many other things.

Unfortunately, by the time many people realize this, they have already done some things to set their credit scores back.

To improve and maintain your credit score, you need to monitor it.

Websites such as Credit Karma will give you your score for free, but they often provide only 1 of the credit reports rather than all three. Federal law authorizes one website to give you all three of your entire credit reports once a year: AnnualCreditReport.com. Take advantage of it!

Key Takeaway: Let this be your guide: Start by paying more than the minimum on cards to reduce your balance quickly. Prioritize high-interest debts for maximum savings. Financial stress can cloud your budgeting, but a well-crafted plan keeps you steady. And don't forget – maintaining a good credit score is key.

Building Your Financial Future: Saving and Investing

The path to achieving your financial dreams starts with two simple steps: saving money early and investing it wisely.

Starting sooner allows your savings to grow over time, leveraging the magic of compounding interest.

“Investing is not just about making more money. It's a strategic move that helps keep pace with inflation, ensuring that your hard-earned dollars retain their purchasing power.”

– A wise investor

In essence, saving early AND smart investing are cornerstones of building a solid financial foundation for future goals.

A Diverse Portfolio: The Key to Effective Finance Management

Diversifying investments isn't just a buzzword in finance; it's an effective strategy for managing finances. Think of it as not putting all your eggs in one basket. By spreading out investments across various assets like stocks or real estate, risk is mitigated while potential returns increase.

- Stocks may provide higher returns but come with greater volatility.

- Bonds offer stable income streams but lower return rates compared to stocks.

- Real estate provides tangible assets that can appreciate over time, plus rental income opportunities.

Navigating Market Changes With Ease

All markets fluctuate naturally – some sectors may struggle while others thrive at any given moment. That's where diversification comes into play. It balances losses from underperforming sectors with gains elsewhere in your portfolio.

Most people hope to reach financial independence at the relatively standard retirement age of 65, or even earlier, if desired and possible. It will all depend on how much you have saved and by what age.

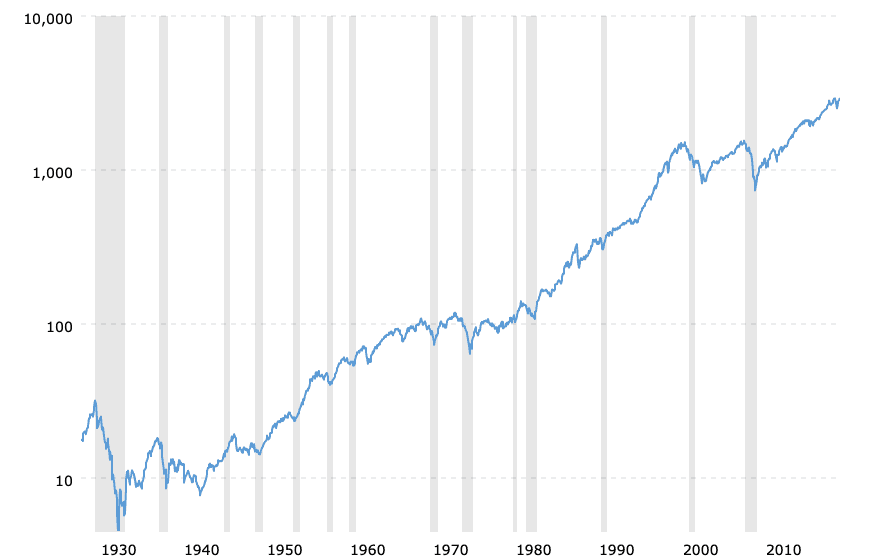

With a diversified market portfolio, you can expect to grow your savings by 7-10% annually.

This chart from Macrotrends shows the S&P price growth from $19 in April 1928 to $2933 in April 2019. If you look at this S&P 500 returns calculator, you will see that it reports a CAGR of 9.69% with reinvested dividends.

Other asset classes like bonds, commodities, REITs, cash, etc., on average, over similar periods of time, have not performed as lucratively.

The earlier you start paying attention to your finances, establish your end goals, and realize how money tracking, saving, and investing can help you achieve your goals, the better off you will be.

Key Takeaway: Kickstart your financial dreams with two steps: 1. Save early 2. Invest wisely. It's the mantra for securing financial freedom in the future. Diversify to mitigate risks, navigate market changes smoothly, and unlock the magic of compounding interest.

Three Steps to Secure Your Retirement

Planning for retirement can be challenging, but with the proper method, it is very achievable. Here are three steps you can take to achieve long-term financial security in your golden years.

1. Start Early and Plan Well

To build a substantial nest egg for retirement, starting early is key.

Before anything else, the first step towards achieving your retirement savings goals is creating a comprehensive plan – an easy-to-follow system that allows consistent saving and investing over time.

If you want to overcome potential hurdles on this journey, implementing yours should be priority number one.

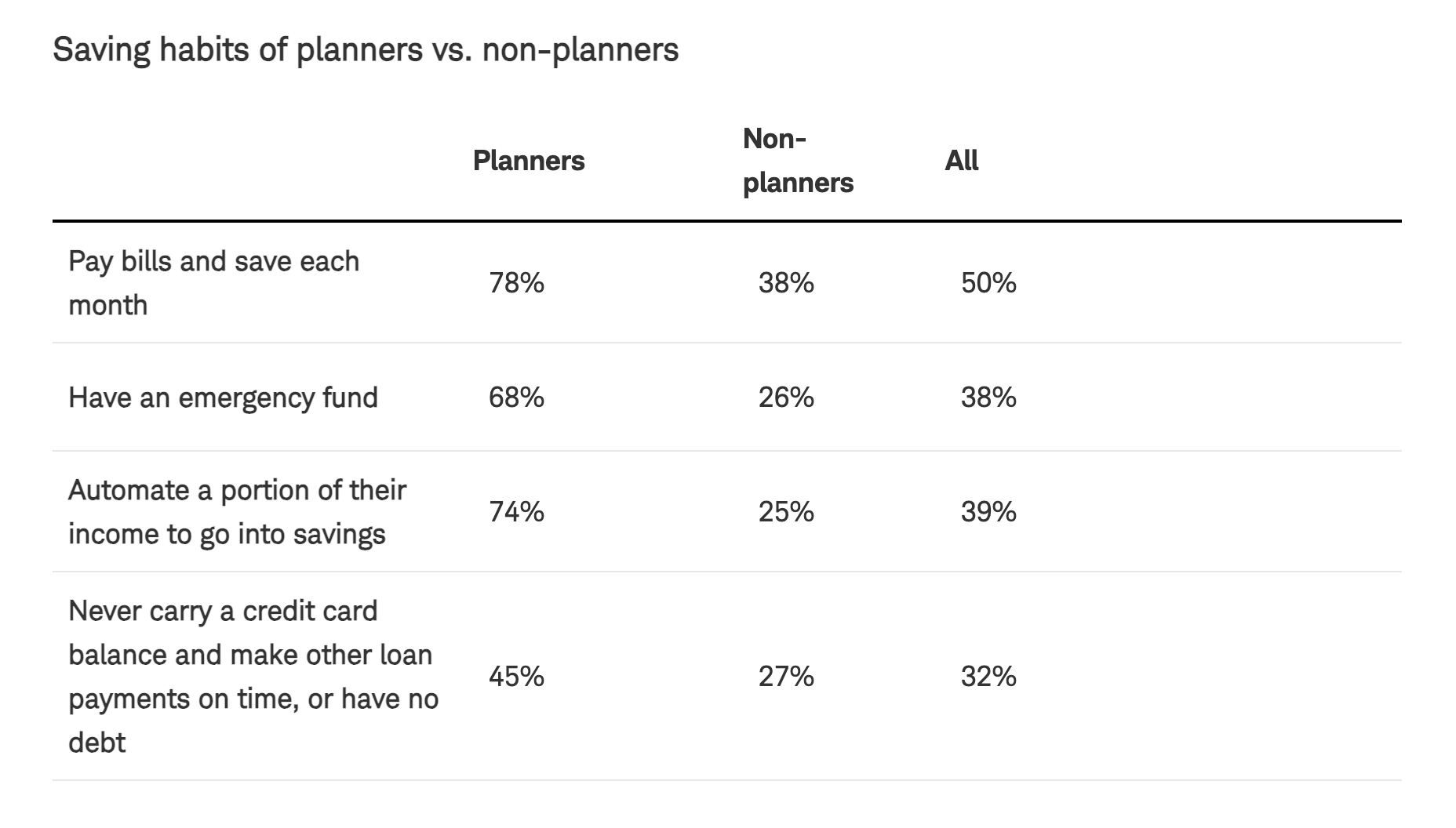

Additionally, studies have shown that those with a plan demonstrate healthier money habits overall.

Charles Schwab 2019 Modern Wealth Survey

Charles Schwab 2019 Modern Wealth Survey

2. Choose The Right Retirement Plans

Your choice of retirement plan plays a crucial role in ensuring financial stability during your non-working years—it needs to be just right.

- Diversify: Don't put all eggs into one basket. A mix of 401(k), Traditional IRA, Roth IRA, or SEP-IRA could possibly generate the highest gains while keeping risk low.

- Evaluate: Assess each option carefully—consider factors such as income level, employer offerings (if any), age at which you intend to retire, and expected post-retirement expenses before making choices.

- Tailor-make: Create a personalized investment portfolio based on these evaluations that align with your specific requirements and expectations from life after work ends.

If you want further clarification and assistance with these steps, visit this article: The Financial Planning Process: How to Mastermind Your Retirement.

3. Consistent Contributions Over Time

Regularly contributing to selected retirement plans is as important as choosing the right ones.

Here are a couple of tips to ensure consistency:

- Perform a Retirement Fund Calculation: Determine how much money (per year) you will need to retire.

- Create a budget: A well-thought-out monthly budget can help allocate funds towards retirement savings without hampering current lifestyle needs.

- Set up auto payments: To keep things smooth, think about arranging automatic transfers to your savings.

Every “version” of retirement requires thoughtful planning, diligent saving, and GOOD BOOKKEEPING to be achieved. What you want to avoid MOST is being trapped in a situation you are unhappy with in the end.

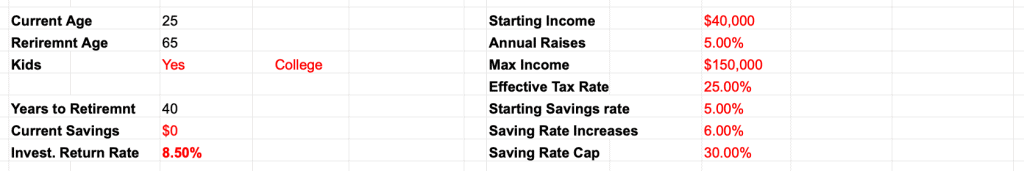

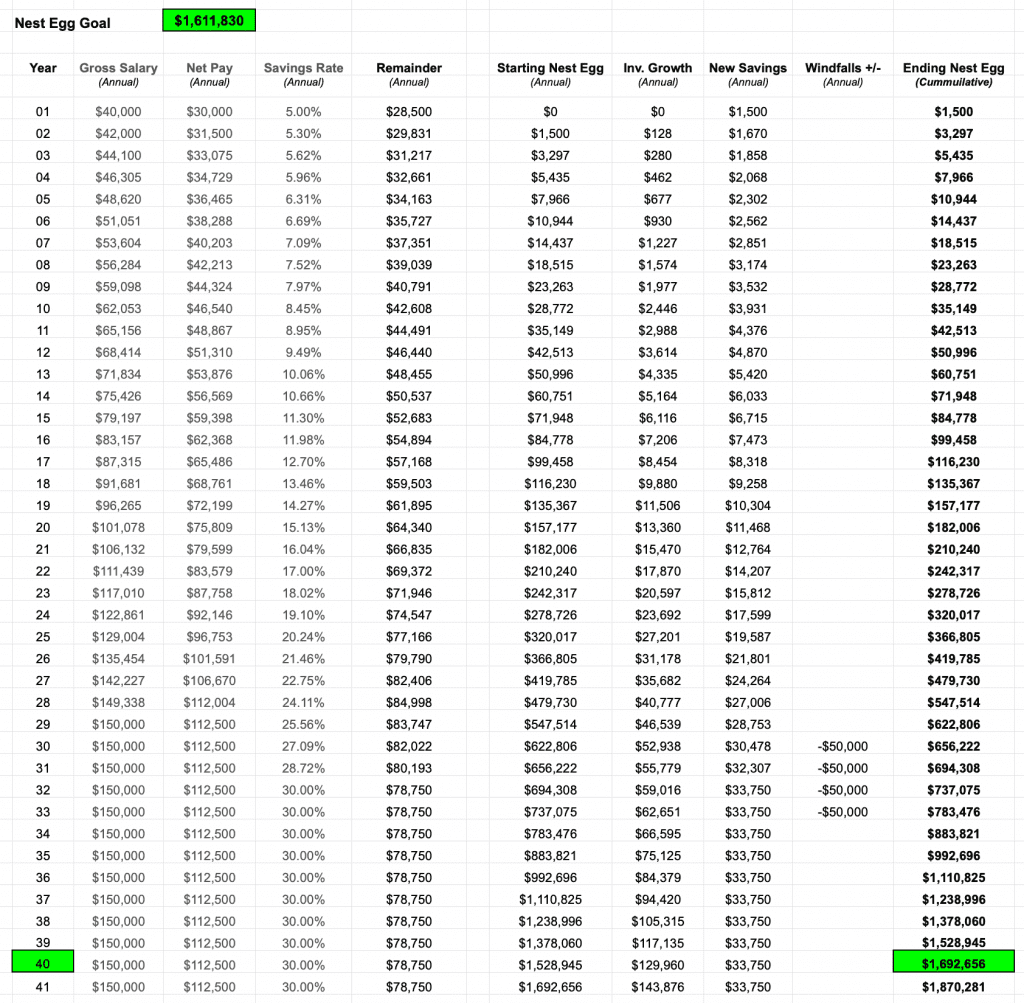

My Retirement Planning Calculator

Here's a sample of how your annual savings will accumulate to create your retirement nest egg. Below, I've included a screenshot of the calculator I made that shows how much your “savings over time,” which is also “compounded over time,” adds up.

This calculator is available in one of my courses, The Financial Independence Roadmap. I've made it easy to adjust the metrics in red to see how different scenarios play out and how that affects your nest egg accumulation.

The simulator will help you figure out how much you need to save and by when to reach your goal. You then incorporate those required savings into your budget.

If you create something like this for yourself, you can start to plug in real numbers at the end of every year and essentially merge reality with your plan!

You want to do this to see whether your progress has you only inching towards your goal versus potentially getting there sooner!

Key Takeaway: Planning for your golden years doesn't have to be scary. Start early, map out a comprehensive plan, and stick with it, making adjustments over time.

Additional Money Management Tips

You want to do this to see whether your progress has you inching towards your goal or potentially getting there sooner!

Here are some valuable methods to assist you in controlling your funds.

1. Adopt Regular Budget Reviews

How can you ensure that your fiscal objectives are achieved? How do you adjust when unexpected expenses arise? The answer lies in regularly reviewing and adjusting your budget.

The secret to success here is the 50/30/20 rule – a simple yet effective guideline for allocating your after-tax income: 50% towards necessities, 30% towards discretionary spending, and the remaining 20% towards savings or debt repayment. Following this strategy can achieve financial health and realize your dreams.

2. Master Your Income Tax Knowledge

To truly excel in managing your personal finances, it's important to understand income tax – it's not as intimidating as it may seem. Being aware of available deductions and credits can help reduce your taxable income while keeping the taxman satisfied.

Learning about taxes doesn't require rocket science; anyone can grasp the concepts with time and patience. Once you've mastered tax knowledge, it becomes another valuable tool in your arsenal for better money management.

3. Seek Professional Advice When Needed

Sometimes, things can get complicated – whether it involves property or running a small business – that's when professional advice becomes invaluable.

Financial advisors, accountants, or certified financial planners (CFPs) offer personalized guidance tailored to your individual circumstances and long-term objectives. They can assist you not only in planning but also in effectively implementing wealth-creation strategies.

Seeking professional help is like having a trusted co-pilot on your financial journey, ensuring you're always heading in the right direction.

If you'd like to speak with me, I offer a free 20 minute phone call to assess your needs. I also have several free courses, as well as paid, to choose from on my site.

Key Takeaway: Crack open the world of finance with three simple strategies: keep a close eye on your budget, befriend income tax basics, and don't shy away from professional advice when things get tricky. Use these tools to navigate your money matters like a pro.

FAQs about How Can I Manage My Finances

What is the 50-30-20 rule for managing money?

The 50/30/20 rule breaks down your income into three categories. You spend half on necessities, use thirty percent for wants, and save twenty percent.

What is the 30-20-10 rule?

The lesser-known cousin of the first rule suggests putting aside thirty percent for taxes, keeping twenty percent as profit, and reinvesting ten percent back into your business or financial goals.

What is a 50-30-20 budget example?

For example, if you earn $5,000 monthly, you would spend up to $2,500 on essentials like rent or food (50%), allocate no more than $1,500 toward wants (30%), and save at least $1,000 (20%).

Why am I struggling to manage my money?

There are several reasons why you may struggle with managing your money. It could be due to a lack of education about personal finance principles, impulsive spending habits, debt burden, or not setting clear financial goals.

Conclusion

Managing your finances effectively is crucial for a secure financial future.

First and foremost, developing a money mindset is key to achieving financial success. Overcoming any limiting beliefs about money will open up opportunities for prosperity.

Setting realistic goals and creating a budget are also essential steps. Be sure to set timelines for your goals to keep yourself accountable. Budgeting allows you to take control of your spending habits and ensures you have enough funds for your needs, wants, and objectives.

Another important aspect is building an emergency fund. Having a financial safety net in place can provide peace of mind during unexpected circumstances and reduce financial stress.

Managing debt effectively and understanding credit scores are also crucial for maintaining good financial health. Make sure to diversify your investments wisely to ensure long-term gains and security.

Remember, managing your finances is an ongoing journey, so never stop learning and seeking ways to improve your financial management skills.