You wake up in the morning and hop out of bed, ready to tackle the day! You throw on your best outfit and do your morning routine, grateful that you own a small business and have the luxury of working on your own terms.

Then, you look at the calendar and realize it's the second Friday of the month, and all your enthusiasm is gone in a poof—payroll day. You groan and think to yourself, “How come there isn't a way to make payroll easier?” Little do you know about Gusto Payroll.

If you run a business, you know that payroll can be a huge pain in the butt. According to some surveys, payroll can take small business owners up to 5 hours per pay period to complete. On top of that, statistics say that over 40% of businesses incur payroll-related penalties with the IRS. Payroll is a headache for most small businesses, to say the least.

What if there were a way to cut payroll errors in half, do automatic calculations of deductions for old and new employees, and essentially run payroll all in less time than you could manually?

Enter Gusto Payroll. There are payroll services and software on the market today that help with these common issues, and Gusto happens to be one of them. This post will explain Gusto Payroll's pricing structure and thoroughly review its pros and cons.

Are you ready to avoid more headaches, get professional, and start using cutting-edge payroll software? Let's dive right in.

What is Gusto Payroll

Before doing a deep review of just how good Gusto Payroll is, it's important to understand what exactly the company does.

Gusto Payroll is a payroll processing business/software that currently processes over $10 billion worth of payroll every year and serves over 200,000 businesses across America.

Launched in 2012, Gusto Payroll is your one-stop shop for all things HR, payroll, and benefits-related. It comes with everything you need to run your payroll, administer your benefits, and even take care of your tax filings.

Some of the features that you'll find are:

- Automated payroll for salaried employees (every pay period)

- Unlimited payroll runs (unlimited payrolls)

- Direct deposit

- Tax filings (payroll taxes)

- W-2 tax forms

- 1099 tax forms

- Health Insurance

- Hiring and onboarding

- Employee Benefits

In addition to all these, it's also extremely easy to integrate Gusto Payroll into your business. Depending on the plan that you choose, employees and new hires can log in and onboard themselves by simply entering their details and filling out their W-4. Furthermore, Gusto Payroll features some awesome reporting features and integrates really nicely with various accounting software like QuickBooks, Xero, and Freshbooks.

Finally, Gusto Payroll has some of the best HR functions out of all its competitors. Depending on what plan you decide to sign up for, you'll have access to premium hr tools like the employee handbook wizard, HR forms, and even company culture assistance.

Gusto Payroll: Pricing

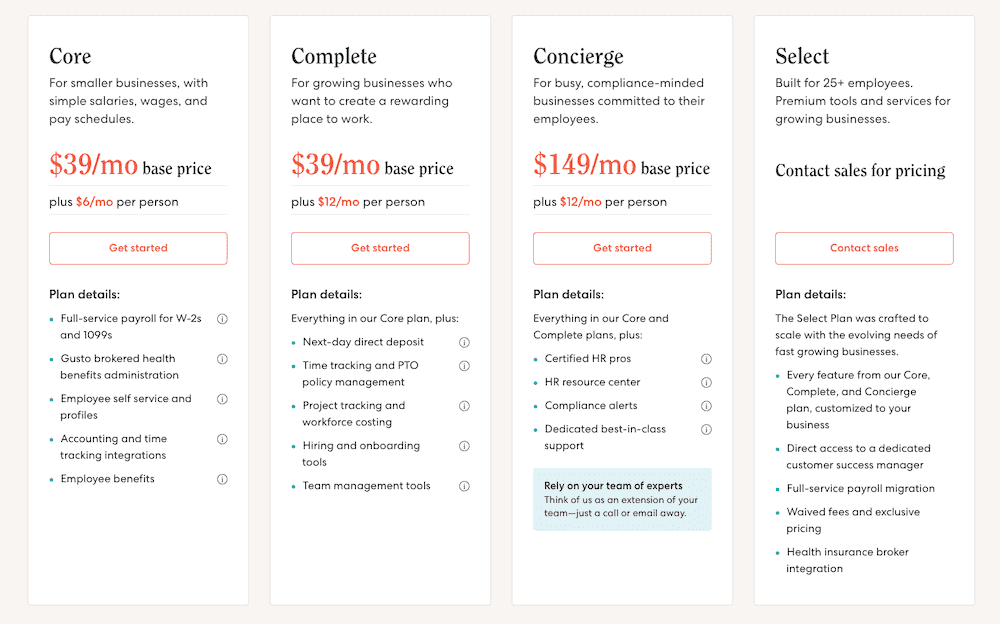

Of course, no matter how good an application is, how much you pay for it matters. As a small business owner, you can choose from four different plans for Gusto Payroll.

The first one is the core plan, which is best for small businesses with very straightforward salaries, wages, and pay schedules. This plan has a base price of $39/month plus an additional cost of $6/month per person. With the core plan, you'll get:

- Full-service payroll for employees filing W2s and 1099s

- Brokered health benefits

- Employee profiles and self service

- The ability to integrate Gusto with time tracking and accounting software

- Employee benefits processing

If you happen to run a slightly more developed business with various different kinds of employees, you might want to consider the complete plan. For a base monthly fee of $39 and an additional fee of $12/mo per person, you'll get:

- Everything that was included in the core plan

- Next-day direct deposit

- Time tracking and paid time off policy management systems

- Customizable hiring and onboarding tools

- Robust team management tools

Let's say you have a REALLY busy business that has a heavy focus on compliance. If so, the complete plan might not be enough for you and you might fare better with the concierge plan. With the concierge plan, the pay rate is $149/mo plus an extra charge (employee fee) of $12/mo per person. What you'll get in return is:

- Everything you got with the complete plan

- A team of human resources pros that you can contact any time of the day

- A direct line to priority phone support (customer service)

- An entire HR resource center

Beyond these capabilities, the pricing really starts to vary (and starts to impact your bank account quite a bit) so Gusto Payroll recommends you contact sales for pricing on anything above the concierge plan.

Who is Gusto Payroll Best For?

The ideal Gusto user is a business that's small enough for Gusto Payroll to run efficiently but large enough to handle the costs. Typically, this means that Gusto Payroll is the perfect solution for businesses on the smaller side of operations.

In fact, because of its helpful customer support, seamless integration into various accounting platforms and software, and awesome human resource management offering, Gusto Payroll actually won an Editors' Choice award for small business payroll services in 2021.

If you're a business with anywhere from 1-50 employees and want a payroll service that will be there for you every step of the way, definitely check out Gusto!

Pros and Cons of Gusto Payroll

Before making any investment (of your time, resources, or energy), it's important to weigh all of the advantages and disadvantages. Here are some of the ways that Gusto's plans stack up against other payroll systems:

Pros of Gusto Payroll:

- Awesome user experience—between expert advice, innovative solutions, and easy-to-use payroll tools, Gusto really makes handling all the admin work for your business easy and enjoyable.

- Thorough employee records – some payroll systems will let you do one thing and one thing only: pay your employees. Gusto Payroll has systems in place to keep flexible yet thorough employee records (which you scoff at now but will definitely find useful when the time comes)

- Special contract plan – if you haven’t hired any W-2 employees yet, you can enroll in their contractor plan, which costs only $6 per contractor, with no monthly base cost.

- Customizable reports—The worst thing is when your software gives you a report full of information that you don't need. With Gusto, you won't need to worry about that, as all the reports are customizable.

- Mobile access – with Gusto Payroll's mobile app (which is available on both Apple and Android devices), employees can easily access their tax documents, pay stubs, cash accounts, and more!

Cons of Gusto Payroll:

- You may experience some slow screens – some pages on the website load slowly, which can be really frustrating when you want to get your payroll done and over with as quick as possible.

- Core plan might be limited – there is the possibility that your business is only big enough to afford the core plan but requires the capabilities of the complete, or perhaps even concierge plan.

Offer your clients modern payroll, benefits, 401(k), workers' comp, and more. We migrate your data for free to make switching to Gusto easy. Compliance. Payroll Services. Plus you get a $100 bonus when you sign up!

Before Signing Up for Gusto Payroll…

So let's say you weigh the pros and cons and decide that you want to get started with Gusto Payroll. Before jumping right in, make sure you prefer the right info ahead of time so that you can make the most of your free month trial (yes, you get the first month free with some plans).

Here are some things you should prepare before signing up with Gusto Payroll:

- Get an EIN, Employer Identification Number, from the IRS (simply apply for an EIN online).

- Acquire a state or local business ID (some states and local governments require companies have ID numbers for tax purposes).

- Finally, classify your employees. Be sure that you know who is an independent contractor, who is a full time employee, and who is a part time employee.

On you have all of these things prepared, just head over to Gusto Payroll's website to get started. They'll walk you through exactly what you need to do!

Recap: Gusto Payroll

Payroll is an extremely troublesome aspect of running a business if not handled correctly. Not only does it take a lot of precious time away from actually operating your company, but you also run the risk of incurring penalties from the IRS if you slip up.

Thankfully, there are software and applications out there to help you. One of the current leading payroll systems in the world today is Gusto Payroll, a platform dedicated to making onboarding, paying, insuring, and supporting your employees as easy and seamless as possible.

This post has covered exactly how Gusto Payroll works and has also provided a detailed breakdown of each of the four available plans. On top of that, we've also provided some of the common pros and cons of Gusto Payroll so you can compare it to some of the other payroll systems on the market.

At the end of the day, it doesn't hurt to try Gusto Payroll. You'll get the first month free and then after that you can decide whether or not to cut it off. If you're a small business looking for an easier way to handle your payroll and HR, you don't need to look any further than Gusto Payroll.

Related Articles

How to Incorporate Yourself to Save Money (and Protect Your Assets)

Choosing Payroll Software: Square Payroll vs Gusto Payroll vs ADP

The 4 Most Popular Bookkeeping Programs for Your Business

The Current Leading Outsourcing Platforms That Will Improve Your Workflow

Get A Business Credit Card That Won’t Affect Your Personal Credit