Chances are you're reading this because you're an independent “1099” contractor and want to know how much tax you'll need to pay. Or, you're a full-time “W2” employee and want to know how much your taxes would change if you switched to an independent contractor. Either way, my 1099 vs. W2 calculator could help you.

This post will show a sample calculation of the different tax amounts you would potentially pay under each classification. It will also explain the 1099 and W-2 forms and the pros and cons of working as a 1099 contractor or W2 employee.

1099 vs W2 Calculator

DISCLAIMER: Please be advised that I am not a CPA. Verify all results with your CPA. Also note that the tax code changes annually, so calculation percentages will change over time. This calculation was last updated in early 2021. Also, be aware that this example shows a potential tax for a single person not itemizing on their personal tax return. It also only shows federal taxes. It does not include state taxes.

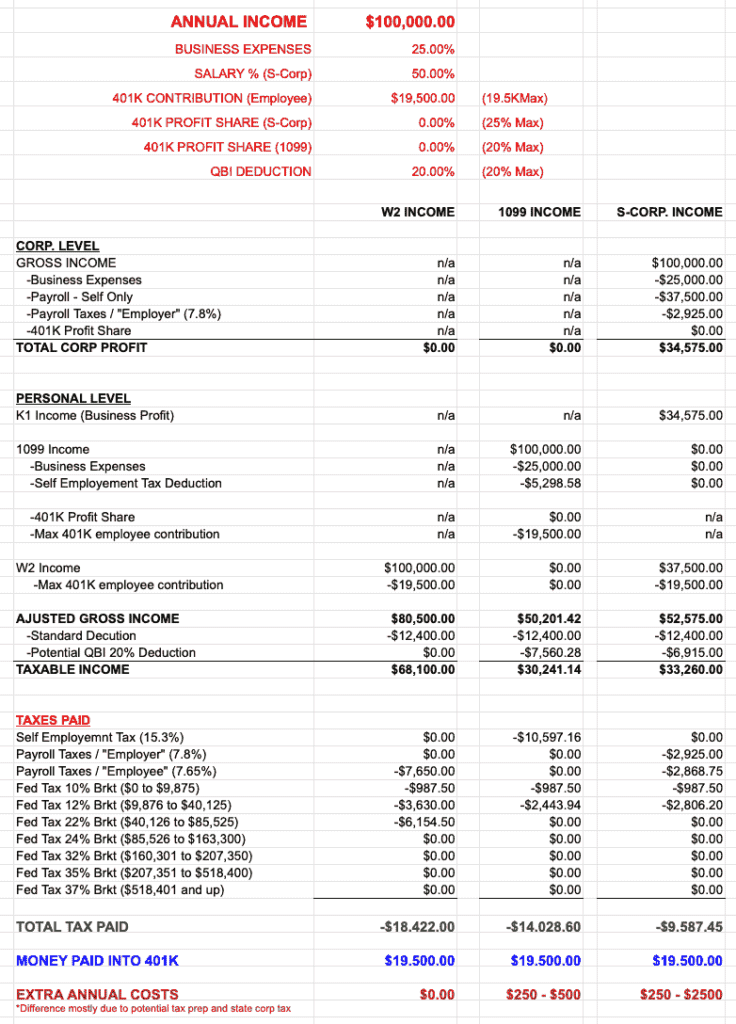

If you're curious about what your taxes would look like should you switch to independent contracting work, take a look at the sample results of the chart below.

As you can see in the calculator, depending on your income, you may be able to do better tax-wise as a 1099 or Scorp. While it's true that you will have to pay self-employment tax, you could possibly overcome that because you will have more business deductions to take advantage of.

Furthermore, if you go the S-corp route, your self-employment tax can potentially be reduced, depending on how much salary your CPA says you should take. So, if you're currently a freelancer or independent “1099” contractor, you might consider incorporating yourself as an S-corp.

Understanding your tax situation is just the start. With our range of courses, from mastering personal budgeting basics to getting savvy with real estate investments, you're set to make informed decisions that align with your financial goals.

Employee Vs. Contractor

As a worker (and even more so as the hiring business), it's important to understand when you are an employee and when you are an independent contractor. The distinction will affect which tax form you'll receive.

This section will cover what might classify someone as a W2 employee and what classifies someone as a 1099 contractor.

What is a “W2” Employee

When it comes down to it, every state is a little different. Some are more rigid than others. California has recently led the charge in being more “strict” about it. Read more about CA's recent AB5 law on the matter.

But federally speaking, the IRS has come up with three broad criteria to help determine who is an employee, freelancer, or independent contractor. The three tests are behavioral control, financial control, and type of relationship.

Behavioral control is the degree to which a business controls its worker's time, work life, and tools. If someone is being trained, directed for tasks, and has specific hours, the IRS will probably classify them as employees. If someone works at home on their equipment, can determine their hours, and works for multiple clients, they would likely be a contractor.

Like behavioral control, financial control describes the extent to which a business controls its workers' money. Some traits of employees are salaries or guaranteed company wages. Independent contractors would generally set their own price, one contract at a time (though their pay is generally governed by the market conditions regardless).

Finally, the type of relationship describes how a business interacts with its workers. If a worker provides services that are related to the business' core work, the IRS will likely view them as W-2 workers. But if the company does photography and the provider does plumbing, then it's a clear distinction.

As a quick run-down, W-2 employees usually:

- Get paid regular wages on an ongoing basis

- Have their work schedule dictated by their employer

- Only work for one client

What is a “1099” Contractor

Someone in an independent contractor position is fundamentally someone independent of the hirer. We can run the 3 IRS tests to see who fits in this category.

Regarding behavioral control, independent contractors typically do their own thing. If the worker sets their hours and decides how (and when) they will get the job done, the IRS will likely classify them as independent contractors.

Again, the distinction regarding financial control is that employers have less of it with independent contractors. If a worker is paid a flat fee per job or project and has a definitive work product result, they are likely a contractor.

Finally, when it comes to the type of relationship, it's usually easiest to look at permanency. If a company hires someone to do a set amount of work for the short term, they are more likely to be classified as independent contractors.

For a quick summary, independent contractors usually:

- Get paid project by project

- Work on their own equipment

- Have control over when they work on the project (relatively speaking)

- Work for multiple clients

1099 vs W2: Which is Better?

If you're a W2 employee, you've likely considered switching over to contract work on more than one occasion. Before you make any meaningful change in your life, it's important to weigh the advantages and disadvantages. Here are some pros and cons of being a 1099 worker vs a W2 employee.

Switching to 1099 work PROS:

- Set your own prices

- Set your own schedules

- Work in your own home office, potentially

- Receive higher pay potentially

- Control your schedule more

- Get significant tax advantages potentially

Switching to 1099 work CONS:

- Pay extra self-employment tax

- Not covered by liability insurance

- Don't receive retirement/pension benefits

- Don't get sick days or vacation hours

At the end of the day, it really comes down to control. Someone who hates being told what to do and wants control over their own time may be better suited to switch to 1099 work. On the contrary, if you're content to receive standard pay and lots of benefits from work (and are more risk-averse) it may be best to stay in your W2 position.

Types of Tax Forms

A 1099 and a W-2 are year-end tax forms that report your income to you and the IRS (Internal Revenue Service). That being said, they are also terms that are commonly used to describe how someone works.

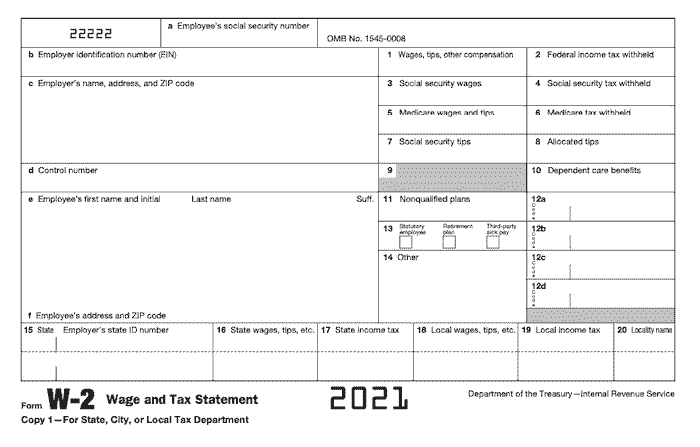

What is a W-2 form?

A W-2 is a tax form where businesses report the amount of annual gross income they payout to an employee and the payroll taxes withheld from the employee.

On your end as the employee, you'll receive a form by January 31, come tax time, detailing how much you've earned the previous year, how much was deducted for taxes, and how much was contributed to retirement plans. Then you'll assemble your income tax return, send it to the IRS (and hope for a tax refund).

You use this form to help you file your tax return. The IRS will also get a copy of this to know how much money you made and how to tax you accordingly.

The W-2 form typically contains the following:

- Personal contact information from the employee and social security number

- EIN or the Employer Identification Number, which is how the IRS knows the company

- Employer name and information

- Tax deductions (e.g., medicare taxes, Social Security taxes, health insurance premiums)

- Contributions

- Salary and bonuses

Remember that the W-2 is only sent to “full-time” and “part-time” employees being paid through a company's payroll system.

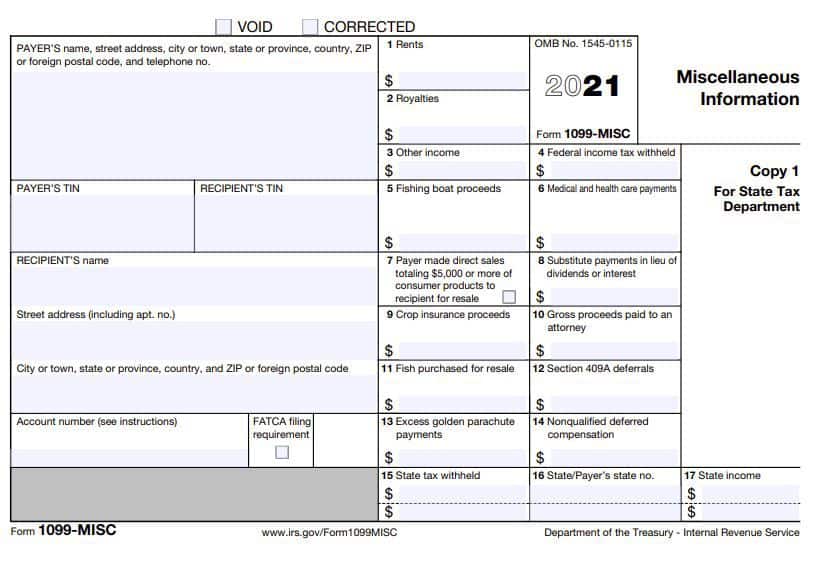

What is a 1099 form?

A 1099 form is similar to a W-2 in that both are documents the business provides to you at the end of the year. The difference with 1099s is that they are only sent to independent contractors. They can be sent to independent contractors that are not incorporated and ones with an LLC.

Any business or individual that pays an independent contractor or an LLC more than $600 in the calendar year is responsible for sending the contractor a completed 1099 form. A copy will also get sent to the IRS so they know how much the contractor was paid.

From the independent contractor's perspective, you will receive a 1099 from each of the clients you worked for. You will then need to use the total of your 1099s to calculate your total income.

If you read into it, you'll find that there are tons of 1099 forms—for example, the 1099-DIV, 1099-INT, or 1099-G. Don't worry about these. For your purposes as an independent contractor, you'll likely only run into Form 1099-MISC or Form 1099-NEC.

It's important to understand that 1099s are only given to independent contractors. This means businesses are not required to deduct any of the contractor's income or payroll taxes on the contractor's behalf. The business also does not have to pay any employer-covered payroll taxes for that worker.

The independent contractor has to report their income and pay all those taxes themselves. This gets done via the “self-employment” tax on the “schedule c” of the contractor's personal tax return.

In Conclusion

At the end of the day, the W2 and 1099 are both year-end tax forms that you'll receive detailing how much money you've made. A full-time employee will receive the W2, and an independent contractor will receive a 1099.

Whether you should switch from being a W2 worker to a 1099 worker is completely dependent on your situation. Switching might be a good idea if you value control over how you do things. On the other hand, if you value stability and security, you might be better off sticking to a W2 position.

Related Articles

How to Incorporate Yourself to Save Money (and Protect Your Assets)

The Financial Planning Process: Your Route to Financial Independence!

Solo 401k vs SEP IRA: A Comparing For the Self-Employed

Can I Work and Collect Social Security

Making a Will – 10 Facts You’ll Definitely Want to Consider

What Is an LLC? And How Is It Different Than a Corporation?